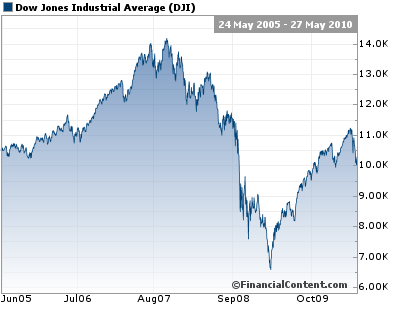

Compared to a year ago, many economic indicators are up: the stock market, even taking its recent ‘fat-finger’ plunge into account, has recovered substantially. According to NAHB’s Eye on the Economy, home sales are up, prices are up, housing starts are up, and inflation is flat.

Anecdotally, builders I speak with are seeing things perk up as well. I was at NAHB’s National Green Building Conference in Raleigh North Carolina last week and all of the builders I spoke with had similar tales: doing fewer remodel projects as a way to get by and more nerw homes.Most said that margins are still very thin, but sales are unequivocally up.

Some of the new houses are custom, and some are spec. One builder I talked with was beginning a handful of high-end spec homes. Remodelers I talked with, like Michael Strong, were genuinely optimistic about business: things are going very well in Houston for Brothers Strong.

In preparation for some video shoots, one of my colleagues, Rob Wotzak, forwarded to me an email from a builder in Massachusetts: the builder listed five or six upcoming projects both new construction and substantial retrofits. This may be a biased slice of the building market because the builders I spoke with were at a green building conference — Brothers Strong specializes in green remodeling and LEED-H houses, and the Massachusetts builder has deep energy retrofits and super-insulated homes on this docket.

What is your experience out there in the rest of North America, are we there yet?

Vote in the poll, and comment below telling us where you live and what the business is doing.

<br /> <a href=”http://answers.polldaddy.com/poll/3062215/” mce_href=”http://answers.polldaddy.com/poll/3062215/”>Is The Housing Market Turning Around?</a><span style=”font-size:9px;” mce_style=”font-size:9px;”><a href=”http://polldaddy.com/features-surveys/” mce_href=”http://polldaddy.com/features-surveys/”>online survey</a></span><br />

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Reliable Crimp Connectors

Affordable IR Camera

8067 All-Weather Flashing Tape

The Dow has gained back much of what it lost a year ago; and is almost where it was five years ago.

View Comments

Period Median Average

Median and Average Sales Prices of New Homes Sold in United States

Annual Data

2007 $247,900 $313,600

2008 $232,100 $292,600

2009 $216,700 $270,900

Appears that average prices are still falling.

I'm in The New York suburbs. I started to see a slow down in "06". With less large scale reno plans coming across my desk. It hit bottom the first 1/4 of "08", there was nothing going on except lay off's. With energy tax credits being given and clients taking advantage of hungry contractors, I am seeing an uptic in the renovation market here. At least I was able to hire back two of my oringinal men. Although, I still see and hear from local realators that there is hardly anything moving in the housing market. I still see for sale signs on homes that have been on the market for over a year. Also more forclosure signs, which was something that was never seen in this area.

With time, alot of time, it will all work out. It may not get to the levels of 5-10 years ago, but, eventually there will be some type of leveling out. The bottom underlaying issue, the issue that I hardly hear any of the talking heads comment about. It's the income of the American working class. Or I should say the lack of income. Compared with the rising cost of everything in our lives, not just a few selected catagories that our gov likes to focus on. I mean all areas, food, fuel, taxes, cars, education etc, etc. The income can hardly pay for the day to day expenses of living and rising a family. Not to mention "wants" just the "needs". If the income kept up with inflation and the increase cost of all other items that the average family has to pay for. The typical families income should be 150-200k a year. If that was the case, then you would not be seeing the problems that we have today.

Here's a thought, instead of posting 2 billion $ profit per 1/4 gains after taking 12 billion in bailout $. Maybe you should give back to the very people that made that profit possilbe. Am all for making a profit, but come on man, give us a #@!*-^" break.

Taxes are steadily rising, and property values are declining. If I could sell my house for what it's appraised at, I'd do it tomorrow. Why can't Big Brother give the overtaxed and overworked, middle class a break. I'm tired and I'm not even close to 40 yrs old. I make half of what I made six years ago. And am happy to be making that.

Ontario Canada- A brisk spring reminicent of pre-financial crisis and in late June leads slowed to a trickle due to an 8% tax increase in Ontario (HST- Harmonized Sales Tax). Our ignorant leaders decided that when unemployment is at 9% it is a fine time for a tax grab.

We dominate the web in many places and I am thankful that the majority of our builders are booked months in advance. If we had not been marketing consistently on line for years we would have been in trouble today. I am hoping the tax reaction blows over by September.

Florida is still very price conscious and much of the US seems to be risk adverse. Builders are not investing in their businesses because they don't know what to expect.

Our builder in Los Angeles is strong--but that I think is just sheer numbers.

Much of the US seems also to be suffering from very low wage competition for builders.

In short... we are doing fine, however we have very low expectations. We are biding time until the economy improves all across North America.

Lawrence Winterburn

http://www.gardenstructure.com