Conversations about the housing market often converge on a few closely related questions, beginning with “Where is the market bottom?” and continuing with “If we haven’t seen the bottom yet, how much further can it realistically drop?” Homebuyers also might ask, “Given the current cost of credit, is it worth waiting for the market to drop, or should I buy now?”

An analysis published this week by the New York Times points out that there’s little political mettle for the federal government to spend more beyond the billions already spent on programs to stabilize the market, from tax credits to low-interest loans to mortgage modification programs. The story also notes that even members of the National Association of Home Builders don’t expect Congress to authorize a credit program big enough – one in the neighborhood of $25,000 per buyer – to boost the market in a significant way.

“Our members are saying that if we can’t get a very large tax credit – one that really brings people off the bench – why use our political capital at all?” NAHB Chief Economist David Crowe told the paper.

The jobs lynchpin

While there are still calls from other quarters, including William Gross, co-founder of bond-fund specialist Pacific Investment Management Company, to use government funding to refinance at lower rates mortgages the government owns or insures, the current political environment and the increased urgency to reduce unemployment may leave housing to find its footing on its own.

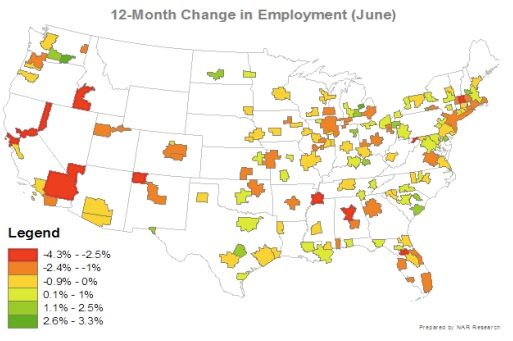

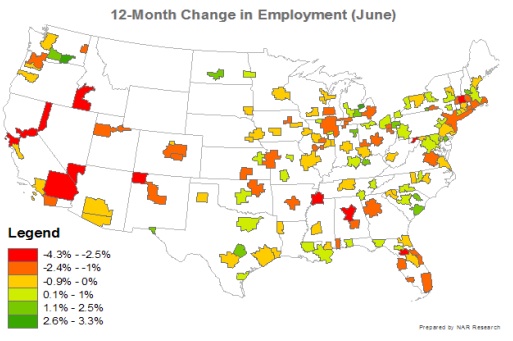

But that doesn’t necessarily mean the housing market bottom will be found down a well all that much deeper than the one we’re in. Key factors in the calculations for market direction are, of course, employment and its considerable influence on consumer confidence, spending, and mortgage delinquency rates. Job gains during the first two quarters were, to put it kindly, evident but anemic. But if employment picks up at least modestly over the next few months – above 1.0% in major markets – it can help offset the temptation to default among current homeowners, many of whom, as the Times notes, have already seen their home equity drop an average of 30%.

In a purely rational terms, says Karl Case, the Wellesley economics professor and co-creator of the Standard & Poor’s Case-Shiller housing index, this is a great time to buy, even if prospective buyers aren’t feeling the joy of low rates and relatively low prices. Case’s observations, published last week by the Times, also were cited in a recent news release from NAHB.

Is there a political solution? We hope so

Part of the backdrop for buyer uncertainty, like the source of anxiety for homeowners, is the jobs market. The unemployment rate has been lingering stubbornly in the 9.5% range, and job gains are extremely hard fought. But unlike another major homebuyer tax credit, unemployment remedies are at least politically feasible, and among the best bets remaining for resuscitating other sectors of the economy, including housing.

The Obama administration’s proposed “infrastructure bank” and call for full-value tax deductions on new equipment (from September 8, 2010, through December 31, 2011) is already being leveraged as much for political advantage in the upcoming election cycle as for consequential policymaking on Capitol Hill. But the ideas give lawmakers a place to start. The hope is they go beyond acknowledging the urgency of the situation and, once the election is over, finally take concrete action.

As Case reminded readers in his Times story, expectations often turn out to be more important than you expect. “One important reason for the recent downturn is clear: The steady drip of bad news about the economy has sapped the confidence of buyers, sellers and lenders,” Case wrote. “And there is no understating the importance of expectations and confidence in this industry.”

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Reliable Crimp Connectors

Handy Heat Gun

8067 All-Weather Flashing Tape

The National Association of Realtors notes that about a third of the 160 metro areas tracked by NAR Research experienced an increase in employment over the 12-month period ending in June, although most of those markets saw gains of less than 1.0%.