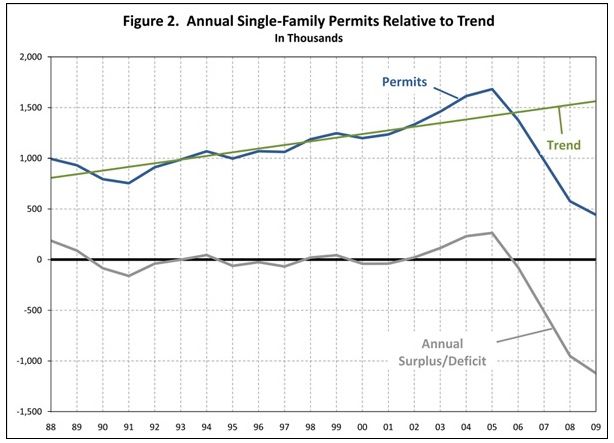

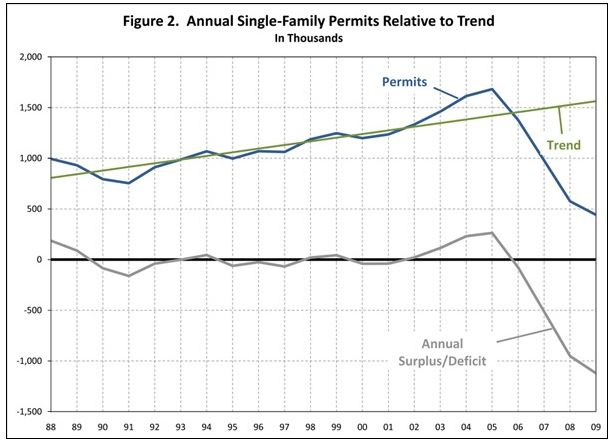

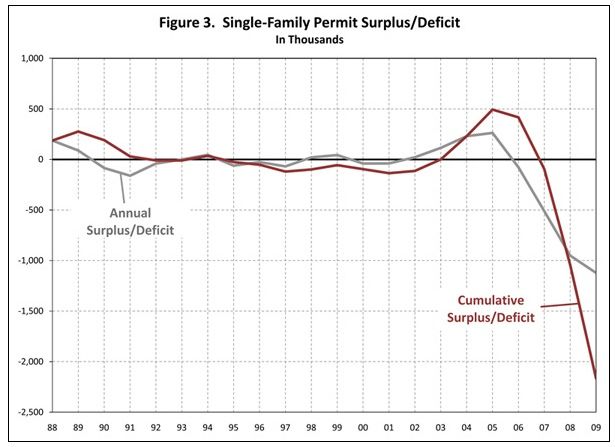

One of the aftereffects of the overbuilding that, until about 2006, propelled the housing market into celestial orbit was housing production’s uncontrolled plunge back to Earth, which not only erased the overbuilt surplus but has continued at a rate of about a million units a year below what would be required to meet demand under normal economic conditions.

A report titled “Extent of Underbuilding in the Single-family Market,” released November 1 by National Association of Home Builders economists Robert Denk and Paul Emrath, describes the nationwide production drop-off – which is apparent on a local level in most states – as the largest since World War II. In other words, the report notes, we’re witness to an historic new-home deficit.

Of course, the deficit has been sustained by the overall economic lethargy that has kept the unemployment rate above 9% and slowed the formation of households well below the 1.2 million annual average increases the nation saw from 1960 through 2005. In other words, the housing production deficit – projected to be 3.28 million units by the end of this year – won’t really feel like a deficit until the job market recovers and household formation returns to form.

“It would be difficult to explain why households would choose to remain bundled together after house prices stabilize and labor markets improve,” and why the … cumulative net deficit in single-family production “doesn’t therefore represent a significant pent-up demand that will at some point need to be worked off and begin to impact single-family housing production in a positive direction,” the report says.

Outlook for credit and demand

NAHB, not surprisingly, has been lobbying hard to open up sources of credit. One of its current points of focus is H.R. 6191, a bill forged in the House of Representatives that would allow small homebuilding companies access to some of the $30 billion in capital lawmakers recently made available to community banks to expand small business lending. Because the current provisions of the capital outlay do not allow construction loans to small builders, however, NAHB is pushing for H.R. 6191 during Congress’s lame-duck session.

The demand component of the puzzle is, as always, the great mystery. While some housing market analysts talk of demand not catching up with supply until 2014, and a “shadow inventory” salted heavily with foreclosures in some markets, housing in many other markets around the country is seen as having already hit the bottom and beginning a slow climb.

In any case, it seems that NAHB, given the extent of the single-family-home production deficit, would rather be ready than caught flat-footed in the markets that show promise.

“Looking ahead to the 112th Congress,” the association said in a recent press release, “NAHB will be reaching out to both sides of the political aisle to seek additional solutions to the current lending crisis and urge Congress to call on federal banking regulators to reduce regulatory restrictions on acquisition, development, and construction credit, and rein in overzealous bank examiners.”

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Reliable Crimp Connectors

8067 All-Weather Flashing Tape

Handy Heat Gun

View Comments

You mention 9% unemployment. Do you have a number for unemployed construction workers and tradesmen? Or are you ignoring the impact on the core of the industry? The labor force.

I'm a 60 year old Carpenter now working as a handyman and doing small remodels and repair. I will not likely be fully employed as a Carpenter for the end of my career. It seems that if even when you are highly skilled no employer wants a 60 year old Carpenter.

Thanks for an answer and maybe some enlightenment in that area. The labor force that is.