The compromise tax package that, after predictably theatrical political contortions, passed Congress this week of course does more than extend the Bush tax cuts for two years and, for 13 more months, extend unemployment benefits. It is, in broad terms, a stimulus package and even includes a little something for builders: a one-year extension of the $2,000 tax credit for those whose new homes use no more than half the energy of comparable homes conforming to the 2003 national model energy code.

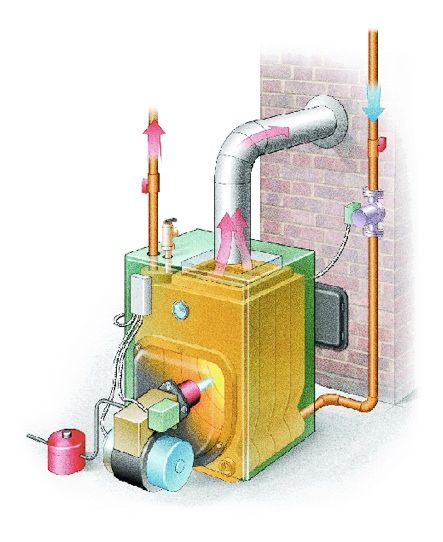

The package also retains tax credits for energy saving appliances and other retrofit products purchased by homeowners, although it reverts back to the rates that were in effect in 2005, when the credits were introduced: a 10% credit, up to $500, on the cost of the products. (From 2008 through the end of this year, the credit covered 30% of that cost, up to $1,500.) The credit for new windows, for example, tops out at $200, $300 for water heaters and wood heating systems, and $150 to $200 for oil and gas furnace and boilers, whose annual-fuel-utilization-efficiency requirement has, under the new law, been increased from 90% to 95%.

The qualification for windows has been loosened slightly to now include Energy Star-rated windows. The credit also covers purchases of qualifying air-conditioners and heat pumps.

Not a bad compromise

Needless to say, the extensions – even those in significantly reduced form – brightened the mood in many quarters, including the offices of the Residential Energy Services Network (RESNET), which noted in a recent email that it was among the organizations that pushed hard for the tax provisions.

RESNET’s executive director, Steve Baden, also pointed out that one of the group’s priorities for 2011 is to encourage Congress to enact legislation for performance-based tax credits.

“This would include creating a performance based credit for comprehensive energy performance upgrades and a higher tax incentive for builders who build homes that are rated a 50 on the HERS Index or lower,” Baden wrote, adding that there will be a session focused on the initiative at the 2011 RESNET Building Performance Conference, scheduled for February 28-March 2 at Lake Buena Vista, Florida. (Click here for a schedule of conference sessions.)

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

8067 All-Weather Flashing Tape

Reliable Crimp Connectors

Handy Heat Gun

Federal regulations require that boilers burning fossil fuels have a minimum annual fuel utilization efficiency of 80%. But boilers with much higher efficiencies are on the market, including condensing boilers fired by natural gas with efficiencies of more than 95%. Those boilers qualify for a consumer tax credit under the provisions of the new tax package approved by Congress.