Whenever government officials and economists declare that the nation’s economy is improving, news reports on the subject often include a disclaimer acknowledging that, despite the occasional uptick in consumer confidence, many people don’t “feel” the improvements, and they’re a long way from bust-out-of-the-blocks exuberance.

In fact, exuberance still seems to be in short supply everywhere except on Wall Street and in executive suites and boardrooms of major corporations, many of which now have a lot of cash but continue to operate with severely reduced staffs and, at least nominally, high levels of productivity.

The point is, homebuilders are as attuned to all this as they are to the credit crunch and the foreclosures that continue to swamp many of their markets. They’re not exuberant, and they probably could have predicted that the Commerce Department figures on housing starts for February would show a significant decline – 22.5%, as it turned out – from January (the seasonally adjusted annual rate landed at 479,000 units). They also could have forecast the sinking permit issuance stat, which showed a drop of 8.2% (to a record-low pace of 517,000 units).

The new young customer

But where their predictive powers could really come in handy is in describing the housing market of the future – a perennial big challenge. The National Association of Home Builders put out a press release on Thursday that edges toward a partial answer. The release cites comments by NAHB/Builder magazine webinar participants who say that the homebuyers who will lead the recovery will be young families and adults aged 31 to 45. In many statistical analyses, adults join the homebuyer demographic when they hit 30, which means Gen X is the target audience. “They are in full force with their careers and they need to accommodate growing families,” said Mollie Carmichael, a webinar presenter who is principal of John Burns Real Estate Consulting in Irvine, California, which conducted a survey aimed at describing the preferences of future home buyers.

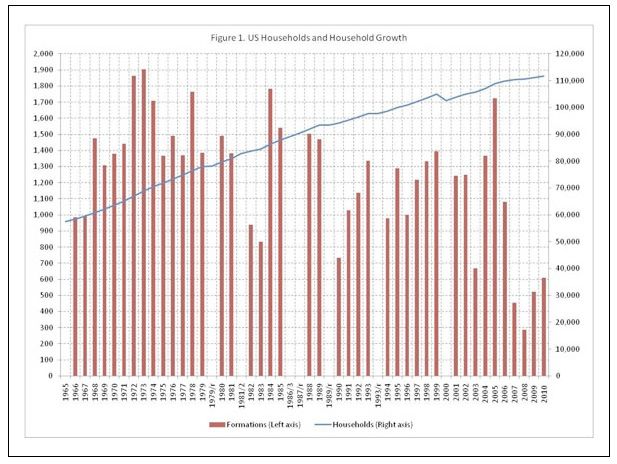

That notion dovetails with the release last month of NAHB study results indicating that household formations, which were delayed from 2007 to 2009 because of the recession, would soon resume and, consequently, create enough demand to absorb much of the existing inventory and help revitalize the market for new homes. (The household-formation graphic posted above accompanied our blog on the study.)

Conducted by John Burns Real Estate, the study surveyed 10,000 buyers and potential buyers in 27 metro areas. Most said they were “optimistic about a new home purchase, with between 85 percent and 89 percent saying that it was a good time to buy a home.”

Seventy percent of respondents said that they were willing to pay $5,000 more for a green home, but also expected new homes to already have many green technology features. Most also said they preferred a great room over formal spaces, and good design will be key to attracting homebuyers, according go panelist Heather McCune, director of marketing at Bassenian/Lagoni Architects in Newport Beach, California.

“The notion of ‘build it and they will come’ no longer works. Design matters,” McCune said.

There will be a preference, she added, for open floor plans, plenty of storage space, and a layout that both segues smoothly with outdoor spaces and creates the impression of spaciousness, even if the home is relatively compact.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Affordable IR Camera

Handy Heat Gun

8067 All-Weather Flashing Tape

Household formations, which help precipitate housing demand, tend to increase when the economy is strong and decline when the economy is weak. A recent NAHB study calculates that 2.1 million household formations were delayed from 2007 to 2009 because of the most recent recession. As economic conditions improve, household formations, including those among Gen X, the offspring of the huge baby boom generation, are expected to accelerate. This chart shows formations from 1965 through 2010.

View Comments

Please repost graph in higher resolution so that we can read it! Otherwise, very interesting article.