As concerned (and thoroughly confused) as consumers might be about the nation’s economic prospects and the government’s ability to steer the country toward recovery and away from insolvency, there are signs one of the economy’s most troubled sectors, housing, might have some life in it.

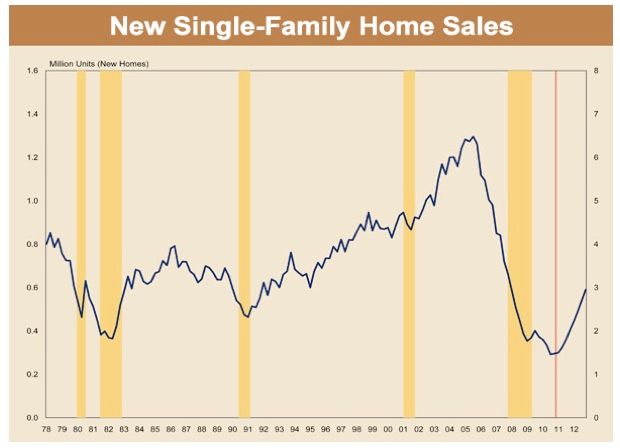

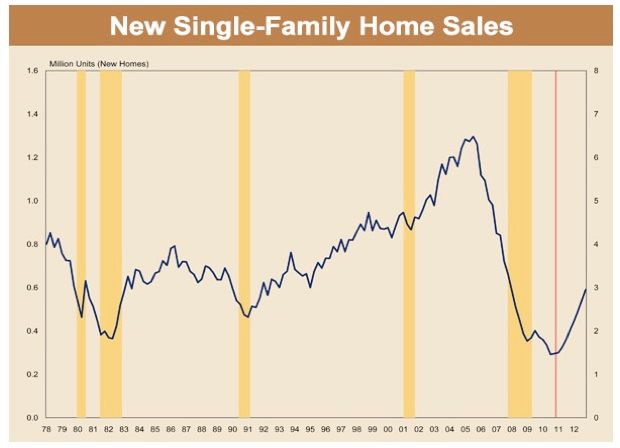

As Forbes.com real estate writer Morgan Brennan pointed out earlier this week, February’s drops in sales figures for existing (9.6%) and new homes (which hit a 50-year low) had some observers not only discouraged but also forecasting a dip in prices and sales like the one that followed the expiration of the homebuyer tax credit last year. The forces currently coming to bear on the market, though, seem to have made it more prone to minor corrections than steep plunges, and contradicted those who thought the market would soon head back into the tank.

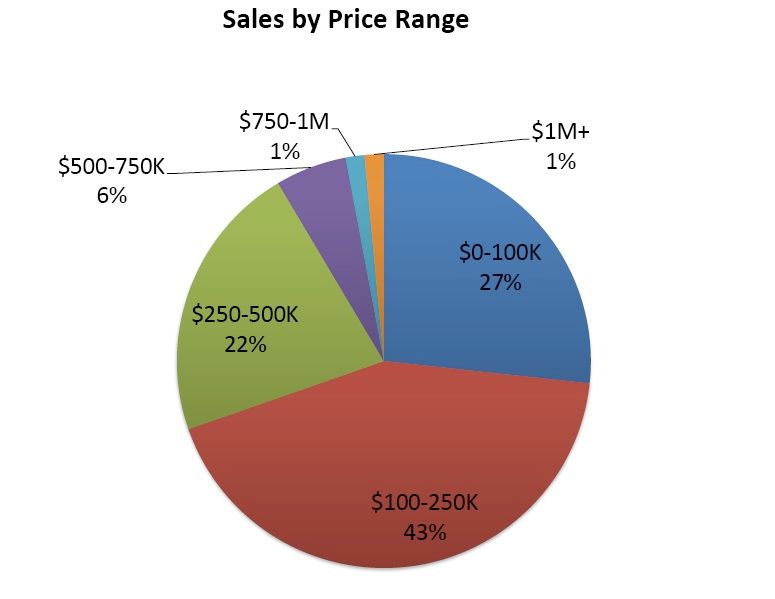

Existing-home sales in March, for example, were up 3.7% over sales in February, according to the National Association of Realtors. NAR data show there were 5.1 million transactions for existing homes in March, versus 4.92 million (revised from 4.88 million) in February. On its website, NAR also presents a list of charts and graphs relevant to sales in March, including a pie chart summarizing sales by price range for February. The sweet spot for existing homes and, naturally, many first-time homebuyers who might also consider buying a new home, is $100,000 to $250,000 – a price range that accounted for 47% of all existing-home sales that month.

A slow climb?

Housing starts also climbed nationwide in March: 7.2%, to a seasonally adjusted annual rate of 549,000 units, according to the Commerce Department. The National Association of Home Builders saw this as an expected seasonal shift that also reflects homebuilders’ cautious response to slight upticks in buyer interest, even though homebuilder confidence in April remained stalled in negative territory.

As we mentioned earlier this week – and as NAHB points out – there are “significant uncertainties among both homebuilders and buyers.” But some of those uncertainties, particularly the ones that could propel rental rates and mortgage rates significantly higher (think “debt ceiling debate in Congress” regarding the latter), might actually motivate prospective buyers to sign purchase contracts sooner rather than later.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Affordable IR Camera

8067 All-Weather Flashing Tape

Reliable Crimp Connectors