Amid the seemingly endless volatility of the stock market, there are at least a couple of analysts who have been taking calm, if sometimes contrarian, views on investment opportunities in homebuilding that point to promising long-term results.

In a September 8 post to Barron’s financial magazine website, for example, FBR Capital Markets analysts Steve Stelmach and Patrick Kealey Jr. said, with a note of caution, that they see “select opportunities” for investors in the near term and hold a positive outlook for the long term. While they acknowledge that, after years of low sales volumes, homebuilders have an understandably jaded view of the market, they also say “the storm is over, but we are waiting for the recovery to unfold.”

“While we see no easy path to recovery in the U.S. housing market,” they add, “there are encouraging signs of a rebound underway.”

Household formations and budding demand

A couple of key observations underpin FBR’s analysis. One is the contention that the oversupply of both distressed and non-distressed homes will linger for some time but not continue to trend upward. The other, which echoes a recent National Association of Home Builders study, is that as the labor market improves, increasing household formations will increase homebuyer demand. These homebuyers, FBR says, will be looking for shelter (because “families need to live somewhere, at a cost”), but unlike homebuyers of, say, eight years ago, they won’t expect double-digit annual appreciation.

The builders in a position to benefit most from a general housing recovery are the

“land-heavy” builders who “possess near-term earnings drivers through distressed-asset acquisitions and opportunistic investments while maintaining what we expect to be very valuable land exposure as new-home sales recover.” These builders have long ago cut general expenses enough to remain stable, the analysis notes, and most have substantial cash and no significant debt payments due anytime soon.

The investment firm says it is initiating coverage of Standard Pacific and Lennar, as well as PulteGroup, Meritage Homes, Ryland Group, and KB Home. All of these firms have The expectation is that annual housing starts, now about 600,000 (down from some 2 million during the boom), will hit 1 million before the end of 2016, representing an annual growth rate of at least 12%.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Affordable IR Camera

8067 All-Weather Flashing Tape

Handy Heat Gun

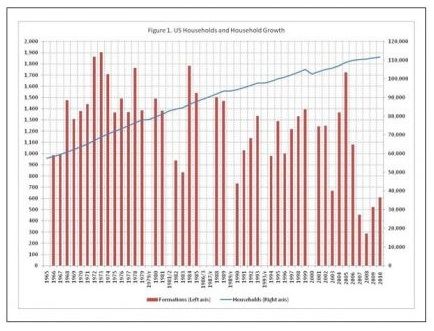

Household formations, which help precipitate housing demand, tend to increase when the economy is strong and decline when the economy is weak. A recent NAHB study calculates that 2.1 million household formations were delayed from 2007 to 2009 because of the most recent recession. As economic conditions improve, household formations, including those among Gen X, the offspring of the huge baby boom generation, are expected to accelerate. This chart shows formations from 1965 through 2010.