Buyer’s Guide: A Plank for Every Deck

Take a detailed look at the wide range of decking options, including plastics, wood-plastic composites, aluminum, hardwood, pressure-treated, and more.

Trex turned the decking business on its ear in the mid-1990s with a composite lumber made from finely ground wood and discarded plastic bags. Now, nearly 25 years later, there are plenty of other makers of synthetic decking, and many more sophisticated products to choose from.

The fundamentals remain unchanged, however: Wood owns most of the market, and the alternatives are all scrambling for the remaining slice of the pie, offering products that need less maintenance but cost more. Whether buyers want to stay with wood or sample one of the many synthetics, there are plenty of choices.

Builders will find no less variety in the kinds of fasteners on the market. Some carpenters still prefer to drive screws, or even nails, through the face of the decking, but most manufacturers of synthetic decking offer boards with grooved edges that are designed to work with hidden fasteners. When installation is complete, no fastener heads are visible, and deck boards are spaced evenly apart.

Hidden fasteners come in a number of variations, including clip systems such as Tiger Claw, EB-TY, or Invisi- Fast; brackets that accept fasteners from below and pneumatic fastening systems such as those made by HIDfast and InvisiDeck.

Other options include CAMO, a guide for driving screws at an angle into the edge of a board, and Cortex fasteners for face-screwing deck boards, which come with color-matched plugs. Plugs are made for a number of decking brands.

Treated or untreated, wood is still great for tight budgets

Starting for as little as 50¢ per lin. ft. for 5/4-in. by 6-in. (typically a true 1-in.-thick by 5-1/2-in.-wide board) pressure-treated southern yellow pine, wood decking still accounts for roughly three-quarters of the U.S. market. Even the least expensive wood-plastic composites cost nearly four times as much, and some types of plastic decking cost 10 times as much.

Despite the advertising budgets and the attention being paid to synthetic decking, the wood-decking market now offers an expansive menu of choices.

In addition to the pressure-treated pine and Douglas fir that have been the mainstays of the market, imported species that come with the blessing of the Forest Stewardship Council are now more widely available. In addition to the exotics, three new kinds of wood decking have found their way into the U.S. market: thermally modified, acetylated, and color-infused pressure-treated lumber.

Naturally hardy varieties

Certain species of wood—cedar or redwood, for example—have long been popular decking choices because of their natural resistance to insects and rot. Provided the decking is milled from heartwood and not sapwood, both cedar and redwood will provide many years of service. Both fade to gray unless they are stained or clear-coated, and because they are relatively soft, they gouge easily.

Species such as ipé, cumaru, and goncalo alves (sold as Tigerwood) are among the better-known tropical hardwoods that offer long-term protection against bugs and rot without the use of preservatives. They’re dark and rich in color when new, fading to a silvery gray in the weather, and they are far harder and denser than cedar, pine, or Douglas fir.

Advantage Lumber, which carries all three species, says these South American hardwoods can last as long as 60 years. Look for decking that carries the Forest Stewardship Council (FSC) label, which certifies that the wood has been harvested responsibly. (Unlabeled wood carries no guarantee of having been harvested responsibly.) It’s worth noting that supplies of certified material can fluctuate up and down.

Pressure-treated

Pressure-treated

Often sold for as little as 50¢ per lin. ft., pressure-treated decking is available at most big-box stores and lumberyards. The newer copper-based preservatives are free of arsenic, and they guard the wood against termites and moisture-induced decay.

Although it shouldn’t rot for a long time, pressure-treated decking is famous for twisting and checking. While applying a stain or preservative will help, these coatings have to be renewed as often as every year or two.

Universal Forest Products has introduced ProWood Dura Color, a color-infused pressure-treated lumber. The company guarantees the product against fading for two years and offers a lifetime warranty against termites and rot.

Alternative preservatives

Two relative newcomers to the wood-decking category in the United States are acetylated lumber and thermally modified lumber. Both offer long-term resistance to rot and insect damage without relying on conventional preservatives.

Acetylation induces a chemical change in the wood with acetic acid. Similar in concept to pickling food, acetylation makes the wood more dimensionally stable, less likely to absorb water, and far less appetizing to insects, according to manufacturers. Acetylated lumber marketed under the Accoya label, for example, is guaranteed for 50 years above ground and 25 years in the ground.

Thermally modified wood has been available in Europe for years but has only recently started to make its way into the United States. The wood is heated in a kiln at temperatures up to 500°F. The heat removes sugars and forces other changes in the structure of the wood, resulting in greater dimensional stability and improved resistance to rot and moisture. One drawback is that the process makes wood harder and more brittle, so count on drilling pilot holes during installation.

Among the brands of thermally modified wood that are available in the United States are EcoDeck (made by EcoVantage) and Arbor Wood. A variety of wood species are used. For example, EcoDeck (roughly $2.50 per lin. ft.) uses No. 1 southern-yellow-pine decking, while Arbor Wood uses ash and red-oak decking ($3.30 to $3.50 per lin. ft.). Neither EcoDeck nor Arbor Wood is recognized by the International Code Council (ICC), but Arbor Wood says it is working with other manufacturers of thermally modified wood on standards that will be recognized by ANSI. The process is approved in Europe, Arbor Wood says. Also, because thermally modified wood is still new, distribution of EcoDeck and Arbor Wood is fairly spotty.

One last type of unconventionally treated wood is a product called TimberSIL. The company’s website says its “glass wood fusion” process improves the wood’s strength and fire resistance, but does so while keeping the product nontoxic. It comes with a 40-year warranty. TimberSIL, about $2.25 per lin. ft. for a 5/4-in. by 6-in. plank, has had some distribution problems, and lead times may be in the six- to eight-week range, at least in the Northeast. Also, the product has recently had some widely publicized problems on projects in Massachusetts and New Orleans, so approach with caution.

Synthetic decking moves far beyond first-generation wood-plastic composites

Although high prices have limited synthetic decking to a relatively small slice of the overall decking market, the products are continually improving in performance and aesthetics. Composites are now offered with an outer shell, or cap, made of a different type of plastic to improve durability, and cellular-PVC boards are manufactured with no wood content at all. You’ll even find composites made with recycled nylon carpeting or rice hulls rather than wood flour.

A number of companies have also begun to adopt a “good-better-best” strategy with their plastic and composite decking—offering a range of prices, performance characteristics, and colors.

All-plastic decking

Hollow, extruded-vinyl decking was the original nonwood option, preceding even wood-plastic composites such as Trex. Although it has since been eclipsed by other products, it still has its place. “Is it a tremendous market share in terms of deckingmaterial type? No,” says CertainTeed senior marketing manager Patti Pellock. “Is it growing? No. But it fills a niche.”

Maintenance for the nonporous surface is minimal, planks are simple to install, and the product comes with a lifetime warranty, Pellock says. But colors are limited, and the surface doesn’t look anything like wood.

Other companies making vinyl decking include Genova Products and Royal Building Products, and vinyl is a popular choice in places where performance trumps aesthetics, such as docks.

In response to problems with early wood-plastic composites, and clamoring by the market for a lowmaintenance product that looked like wood, the industry came up with cellular PVC. Its all-plastic composition meant there was nothing to rot or promote mold (other than surface contaminants). And because of the cell structure created as the PVC was foamed during manufacturing, the cured product handled and worked something like real wood.

But cellular PVC wasn’t perfect, either. Because of the plastic content, it was more expensive than composites. Decking was limited to a light color palette, and there were consumer complaints of fading and discoloration.

Manufacturers responded with capped boards, just as composite makers had done. The addition of a co-extruded cap made possible the dark colors that consumers liked, improved resistance to fading and scratching, and allowed advances such as the digital wood-grain printing in Royal Building Products’ Zuri planks (about $5.30 per lin. ft.).

A number of companies manufacture cellular-PVC decking, including Gossen, CertainTeed, Deceuninck, TimberTech, Veka Innovations, Azek, and Enduris.

Aesthetically, says CertainTeed’s Pellock, there was no longer much of a difference between capped composite decking and capped-PVC decking. Cellular- PVC decking remained more expensive, but it also carried longer warranties.

“In general, wood-plastic composites won’t hold for a lifetime,” Pellock says. “They have wood. You can’t guarantee wood’s going to last a lifetime.”

With the advent of capped composites, Steve Van Kouteren of Principia, a market research and consulting firm, thinks that cellular-PVC decking has lost some of its edge and will see lower demand over time because of its higher cost.

Wood-plastic composites

Despite early setbacks, wood-plastic composites are still thriving. The mix of low-density polyethylene plastic and wood flour that went into the original Trex composite product opened a huge marketing opportunity for the industry. But these first-generation composites didn’t live up to expectations. Because the composites contained cellulose, some products came back with reports of mold, decay, and surface staining.

It was a new product with some rough edges. According to Principia’s Van Kouteren, makers of uncapped composite decking have improved early formulations to make boards more resistant to color fade, mold, and mildew. Also, they’re advertised as “low maintenance,” not “no maintenance,” so consumers have a better idea of what to expect in terms of durability.

Uncapped composites are still available, but many manufacturers have moved toward capped versions, which consist of a woodplastic composite core and an outer shell of another type of plastic. The two materials are bound together as the boards are manufactured, a process known as co-extrusion.

Capping composite boards increased stain and scratch resistance and seemed to solve other performance problems related to cellulose content. And capped decking, or capstock as it’s often called, is typically less expensive than all-plastic versions such as cellular PVC.

Capped and uncapped composite decking is now made by more than a dozen companies, including Trex and AERT, McFarland Cascade, Tamko, TimberTech, Fiberon, and CertainTeed. Most wood-plastic composites are made with polyethylene or high-density polyethylene plastic, but at least two are a mix of hardwood fiber and polypropylene: DuraLife and Iron Woods’ Boardwalk HCX. Both have a co-extruded cap of polypropylene. Although polypropylene is more expensive than polyethylene, manufacturers say that the plastic is tougher and stiffer, and that it has high stain resistance and excellent dimensional stability.

Yet even as products improve, nonwood decking still only captures 20% or so of the total market, says Van Kouteren. Some manufacturers are attempting to solve this problem and coax more customers away from wood by offering different grades of composite decking. Trex, for example, now has three lines of capped boards: Select, Enhance, and Transcend. Prices range from about $2.25 to $4 per lin. ft. (Trex will phase out its uncapped composite, called Accents, this year.)

Adam Zambanini, Trex’s vice president for marketing, says that all three options start with a 50-50 mix of low-density polyethylene and wood. The differences are in the profile of the board(Select decking is 7/8 in. thick rather than the full 1-in. thickness of typical 5/4-in. decking), the properties of the cap material, and the available colors. Transcend, the company’s top-of the-line offering, offers colors designed to mimic tropical hardwoods.

Trex isn’t the only company pursuing this tiered approach. Toby Bostwick, product management director of CPG Building Products, which sells decking under both the Azek and TimberTech brands, says the company wants to offer a good-better-best lineup for its wood-plastic composites, capped composites, and allplastic decking.

TimberTech’s Earthwood Evolutions Terrain decking, for example, is an entry-level synthetic product that aims to help consumers make the jump from wood. Tropical, at the top of the brand’s line of capped products, has variegated streaking designed to mimic hardwoods like Tigerwood. Prices range from $2.60 to $3.70 per lin. ft.

Nonwood composites

Most composites are made with wood flour and plastic. One alternative is GeoDeck, which is manufactured from powdered paper sludge, dried rice hulls, and polyethylene (about $3.25 per lin. ft. for a 5/4-in. by 6-in. board). The company says the hard rice hulls contain silica, which offers mold resistance, and very little lignin, which means better color retention. Terratec Naturals, made by McFarland Cascade, also is a mix of rice hulls and high-density polyethylene.

EPS Plastic Systems’ Bear Board (about $4 per lin. ft.) is a mix of high-density polyethylene and minerals with a 50-year guarantee.

Cali Bamboo’s BamDeck (1×6 planks about $3 per lin. ft.) is made from 60% reclaimed bamboo fibers and high-density polyethylene, a combination the company claims is three times as strong as other composites. It has a 25-year warranty.

NyloDeck, which its manufacturer calls the “noncomposite composite,” is made from recycled carpet fiber and contains no wood. It sells for between $2.50 and $3 per lin. ft., depending on board thickness.

Keep in mind that not all decking is available everywhere. Some brands have limited availability and may not be stocked locally.

Aluminum

If you want a long-lasting, rot-proof deck and don’t give a hoot whether it looks like wood or not, one option to consider is aluminum.

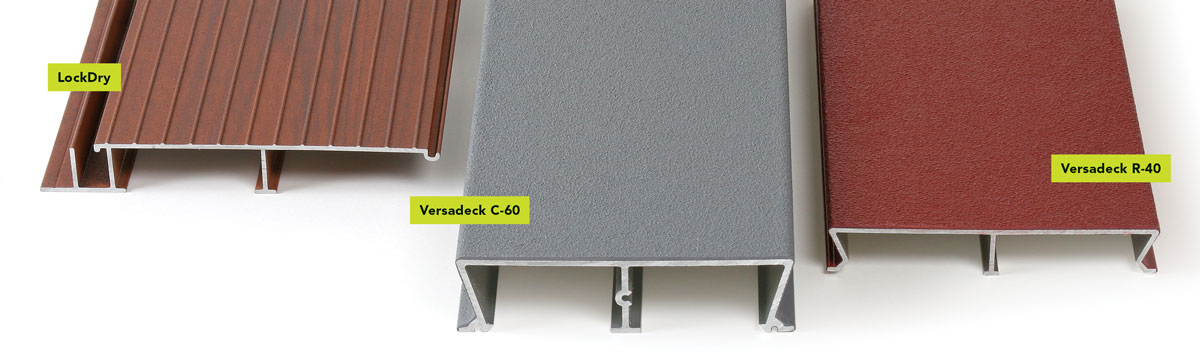

Aluminum decking is made by a number of companies, including FSI Home Products, Versadeck, Wahoo Decks, and Last-Dek. Specs are similar.

FSI Home Products’ LockDry decking, for example, comes in seven powder-coated colors, has a class-A fire rating, has been tested to loads of 240 lb. per sq. ft., and has a nonskid surface.

Once assembled, LockDry ($4.49 per lin. ft. for 6-in.-wide decking) makes a waterproof barrier so that you can use the space under the deck for storage or as a patio. A nonwaterproof version called NextDeck sells for $3.49 per lin. ft.

Index of synthetic decking manufacturers

Listed here and on the next page is a snapshot of current synthetic-decking manufacturers. Keep in mind that the decking market is very active, and companies enter and leave it at a surprising rate. Also, not all of these companies have national distribution. Most building materials, including decking, are sold through what’s called two-step distribution, in which manufacturers supply a limited number of regional wholesalers who then supply lumberyards and home centers. Because of space and inventory-turnover concerns, wholesalers tend to limit the lines of decking they carry to proven profit makers. This makes it difficult for new or smaller manufacturers to find a wholesaler and gain a toehold in the national market.

Plastic

- Azek— azek.com

- Bear Board— epsplasticlumber.com

- Clubhouse Decking— deceuninck-americas.com

- EnDeck— enduris.com

- EverNew— certainteed.com

- Evolve— renewplastics.com

- Fiberon— fiberon.com

- Genovations— genovaproducts.com

- Gossen— gossencorp.com

- Guardeck— guardianbp.com

- Kleer Decking— kleerlumber.com

- Presidio— westechbp.com

- Royal Deck— royalbuildingproducts.com

- SheerGrain— lbplastics.com

- Tufboard— tufboard.net

- VekaDeck— vekainnovations.com

- Wolf— wolfhomeproducts.com

- Zuri— royalbuildingproducts.com

Wood-plastic composites

- ChoiceDek— choicedek.com

- Duralife— duralifedecking.com

- EverGrain— tamko.com

- EverNew— certainteed.com

- Fiberon— fiberon.com

- GeoLam— geolaminc.com

- Latitudes— ufpi.com

- Modern View— modernviewdecking.com

- MoistureShield— moistureshield.com

- PC Decking— premiumcomposites.com

- Rhino Deck— rhinodeck.com

- TimberTech— timbertech.com

- Trex— trex.com

- UltraDeck— midwestmanufacturing.com

- UltraShield— newtechwood.com

- Veranda— verandadeck.com

- Wolf— wolfhomeproducts.com

Nonwood composites

- GeoDeckgeodeck.com

- Lumberock lumberock.com

- NyloDecknyloboard.com

- Resystaresysta.com

- TerraDecknaturescomposites.com

Aluminum

- Arid Decks wahoodecks.com

- Last-Decklastdeck.com

- LockDry nexaninc.com

- Versadeckversadeck.com

To view the original article, please click the View PDF button below.

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

Drill Driver/Impact Driver

MicroFoam Nitrile Coated Work Gloves

Cepco BoWrench Decking Tool

View Comments

For me, the number one issue with composite decking is that it can't be installed as a replacement for wood decking that was installed at 45 degrees on 16" joists. Well over half of the jobs that I see are for decking replacement only. The deck structure is usually good. These clients may be prepared for the extra cost of the decking, but they are never prepared when I tell them we have to tear most of the deck down because composites can only be laid down diagonally on 12" spacing or straight across on 16" spacing. Sure, you don't have to take out every joist, but if you don't the job often looks kind of cheesy. These manufacturers have to come up with a reasonable (not expensive dock planking) re-decking solution that is rated to go diagonally on 16" spacing (i.e. most wood decks) if they ever want more than 20% of the market.

I've always wondered why no one has come up with sheet goods that can be used for decking. Advances in OSB show that such a material could be improved further, and coatings that improve appearance and durability would be possible. Why the need for materials that imitate boards, with the same labor costs?