Financial Reporting: Construction Business Weight Lifting (Part 1)

Construction business owners have to do a lot of heavy lifting when it comes to running their businesses. But many construction businesses make little progress toward their goals because of the heavy lifting.

Lifting weights is a young person’s game. I remember back in the day when I would spend hours in the gym pushing around weights. Like most gym rats, I had a chest and back day, a TRIs and BIs day, a shoulder day, and the dreaded leg day.

And like most untrained wannabe athletes, I had no idea what I was doing.

Although pushing heavy weights around for hours at a time helped me maintain some level of strength, I learned that doing more reps with lighter weights increased my overall fitness and minimized my time at the gym.

Construction business owners have to do a lot of heavy lifting when it comes to running their businesses. But many construction businesses make little progress toward their goals because of the heavy lifting.

Implementing a profit-first pricing strategy, mastering the techniques of financial forecasting, maintaining cash flow, developing a budget, and managing time are just a few of what I would call the “low-reps-high-weight” exercises.

But if you want to make real gains in your construction business, you need to practice the “high-reps-low-weight” exercises also.

In your construction business, these exercises are the reports you need to review each week, each quarter, and each year.

In my previous posts (here and here and here), I showed you how to generate and track the metrics and KPIs (Key Performance Indicators) for your construction business. In this post, I will define the reports that you need to produce and the frequency with which you should review them.

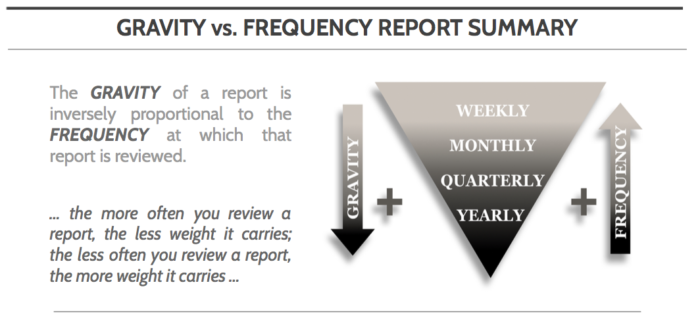

The key to making these reports work for your business is to understand the “GRAVITY VS. FREQUENCY” report summary (shown below).

The key to understanding how to keep momentum going toward your business goals is to know which numbers to review and how often you should review them.

The premise of this reporting method is this:

The GRAVITY of a report is inversely proportional to the FREQUENCY at which that report is reviewed.

In other words:

The more often you review a report, the less weight it carries.

The less often you review a report, the more weight it carries.

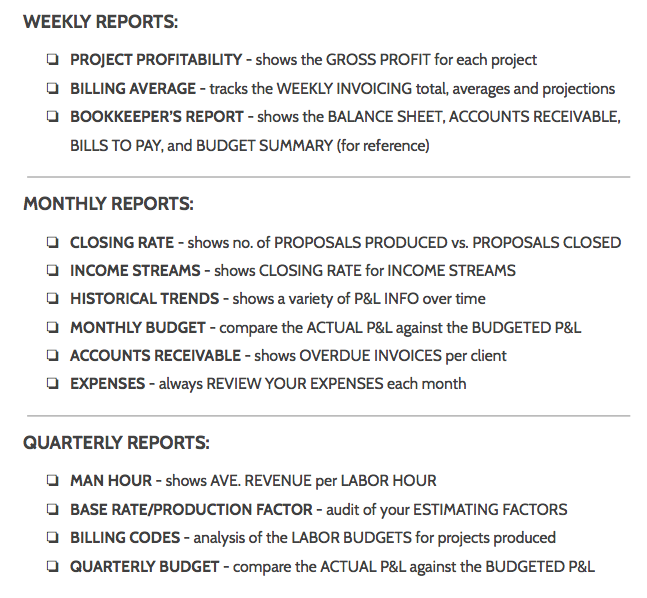

WEEKLY REPORTS:

The weekly reports will enable you to keep a pulse on your business. The weekly reports carry the least amount of weight, but require the most discipline to perform each week.

PROJECT PROFITABILITY

This is your job costing report for each project. This will show your gross margin on each project and whether or not you have a positive cash flow for your projects.

WEEKLY BILLING

This will show you the average weekly billing, total billing, and projected income for the year based on the year-to-date numbers.

BOOKKEEPER’S REPORT

This will show you the BALANCE SHEET, ACCOUNTS RECEIVABLE (A/R), and BILLS TO PAY.

The WEEKLY REPORTS should reveal to you the ACTIONS that your company is performing.

These reports carry less weight because you are looking at them every week. The results from this review shouldn’t cause alarm because you will have opportunities (52 every year) to make minor changes. Develop a habit of reviewing these numbers each week and you won’t be caught off-guard by the other reports when reviewed.

MONTHLY REPORTS:

The reports you review on a monthly basis carry more weight than the weekly reports because they are an indication of your company’s performance over time.

CLOSING RATE:

This report shows the number of total potential project leads and the actual awarded projects. You can use this report to forecast the total revenue, average price, and required number of employees to hit your goals.

INCOME STREAMS:

This report will show the percentage of each stream on income in your business. This will help you focus on the money making activities of your business.

HISTORICAL TRENDS:

This is a review of your business’ dashboard (see my previous post). You will be able to adjust your business activities to compensate for the historical financial peaks and valleys of your business.

MONTHLY BUDGET:

You can compare the Actual Profit and Loss (P&L) statement to the Budgeted P&L. This is when you should reallocate funds or make minor adjustments to your expenses in order to keep your net profits in line with your goals.

ACCOUNTS RECEIVABLE:

Although you will be reviewing ACCOUNTS RECEIVABLE (A/R) in your weekly reports, the monthly A/R report will show you the clients that need to pay overdue invoices. Don’t let your A/R for any client get close to 30 days overdue. If you do, then you are basically financing their jobs. I am sure you did not include that in the Cost of Goods Sold when you priced the job.

EXPENSES:

Reviewing your expense each month will enable you to keep a check on all the money that seeps out of your business. Identify expenses that have exceeded the budgeted amounts and take action to correct the over expenditures the following month.

The MONTHLY REPORTS should help you spot trends within the company.

QUARTERLY REPORTS:

The quarterly reports will offer a broad view of the company and identify trends in income, production, and overall budget performance. Some of these reports will be an aggregate of the monthly reports, but by this point in streamlining your business you will have the data required to analyze the production of the company.

MAN HOUR REPORT or REVENUE PER EMPLOYEE:

This report will show you the average INCOME per MAN HOUR or REVENUE PER EMPLOYEE for the quarter. You can compare this production metric to the labor budgets of your project proposal. If your pricing strategy is off, then you can make adjustments on your next proposal. You won’t have to wait until the end of the job to try to figure out what happened to the profits.

BASE RATE/PRODUCTION FACTORS:

The base rate is a standard price per unit that you apply to each line item in your project proposals. You want to spend some time reviewing this information to make sure your production meets your proposed rates.

The PRODUCTION FACTOR is a factor that you apply to each line item or proposal to account for the unknowns and difficulties of any given job.

Although some things that affect your projects may be unknown at the time of estimating, when you review the Production Factors each quarter, you will be able to establish a factor to account for the unknowns.

BILLING CODES:

These are job costing codes that your company uses to track individual line items or tasks within a project. You need to analyze your billing codes each quarter to ensure that you are actually producing work at the rates which you estimated. You may discover that it takes your crew longer to install a certain kind of work than you estimated. If this is the case, change the way you are estimating or train your crew to meet your expected productivity rates.

QUARTERLY BUDGET:

Just like the monthly budget, you want to compare the Quarterly Actual P&L to the Budgeted P&L. Identify any issues and set a course of the next weeks and months to correct any problems you find.

The QUARTERLY REPORTS should tell you if you are hitting the goals of the company.

YEARLY REPORT:

This is the most important report that you will produce all year. You are only looking at it once so it carries the most weight. The only way you can prepare this report in a timely manner is to perform the more frequent reports.

The Yearly Report sets the course for accomplishing the mission of your company. The mission of the company is the whole reason you are in business.

Running a business is extremely hard work. Don’t make it any harder than it has to be.

High weight/low rep exercises may increase your physical physique, but your business doesn’t need muscle mass.

Your business needs lean, efficient muscle for the long haul.

The best way for you business to build this lean muscle mass is to get on a budget (the diet) and to work in some low weight/high rep exercises (Weekly and Monthly reports).

We all know those guys that can bench press a school bus but can’t make it up one flight of stairs without getting winded.

Don’t be that guy. Don’t let your business struggle by constantly trying to lift the heavy weights.

Building your construction business is like running a marathon, not a strong-man competition.

Follow me on Instagram @shawnvandyke, LinkedIn, Facebook, or shawnvandyke.com to learn more about how to streamline your construction business.

View Comments

http://www.distanceeducationdelhi.co.in/