Financial Reporting: Start with the End in Mind (Part 2)

The YEAR IN REVIEW will enable you to start the upcoming year with the end of the year in mind. You will have a plan. You will have goals, and you will have metrics to track that will get you there.

The Internet attributes Sir Michael Caine, the famed British actor who played Alfred in the Dark Knight movies, with a humorous story explaining how he picks the movies in which he plays.

According to reports, Michael Caine was asked, ‘How do you go about choosing a movie?’

He responded, “Well, what I do, is I sit in a nice, comfortable chair and I read a script they want me to consider. I read the first page, and then I read the last page, and if the part they want me to play is on both pages, I do the (expletive) picture.”

This is an example of starting with the end in mind.

In my previous post, I showed you how the GRAVITY vs. FREQUENCY REPORT SUMMARY will eliminate the need for most of the “heavy lifting” in your construction business in regards to financial reporting.

The YEAR IN REVIEW is the “heaviest” of the financial reports and represents the end of your annual cycle.

Like the hilarious-if-true Michael Caine story, you should start a plan for your business with the end in mind and prepare a YEAR IN REVIEW report. Doing so will help determine the outcome of your business’ script.

YEAR IN REVIEW

The YEAR IN REVIEW is a summary of several Key Performance Indicators (KPIs) and metrics that show the overall performance of your business. The information contained in this report will not only show you what your business did in the past year, but will also help you forecast what your business can do in the upcoming year.

You can customize the contents of the YEAR IN REVIEW for your specific construction or trade business, and I have listed several items below that I recommend including in your report.

CONTENTS OF THE YEAR IN REVIEW

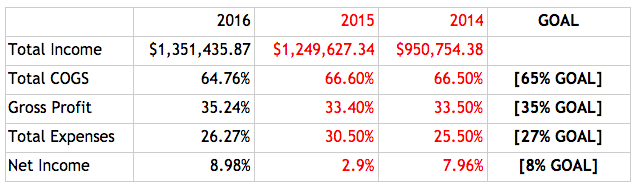

P&L Snapshot Summary

Your Profit and Loss Statement (P&L) shows four basic pieces of financial information:

- Total Income or Revenue

- Total Cost of Goods Sold (COGS)

- Total Expenses

- Total Net Income or Total Net Profit

You will want to see the past year and compare that to previous years.

(See example below)

Use this historical information to set a goal for each of these P&L categories in the upcoming year.

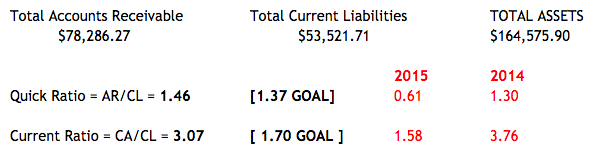

FINANCIAL RATIOS

In order to calculate the items in this section, you will need information from your Balance Sheet.

List the TOTAL ACCOUNTS RECEIVABLE (AR), TOTAL CURRENT LIABILITIES (CL), and CURRENT ASSETS (CA).

Using these numbers, you want to calculate the QUICK RATIO and the CURRENT RATIO.

The QUICK RATIO measures the dollar amount of liquid assets available for each dollar of current liabilities.

QUICK RATIO = ACCOUNTS RECEIVABLE / CURRENT LIABILITIES = AR / CL

The higher the quick ratio, the better the company’s liquidity position.

What does this mean?

It means you can get cash quickly (liquid assets) if you needed to pay some bills (liabilities). The higher the ratio is, the less stuff you have to liquidate in order to pay all the bills (liabilities).

The CURRENT RATIO is mainly used to give an idea of the company’s ability to pay back its short-term liabilities (debt and payables) with its short-term assets (cash, inventory, receivables).

CURRENT RATIO = Current Assets / Current Liabilities = CA / CL

The higher the current ratio, the more capable the company is of paying its obligations.

What does this mean?

The Current Ratio is similar to the Quick Ratio, except the Current Ratio accounts for all assets. The Quick Ratio is just the liquid (easily converted to cash) assets.

Calculate both ratios for the past year and list them with previous years for comparison.

(See example below)

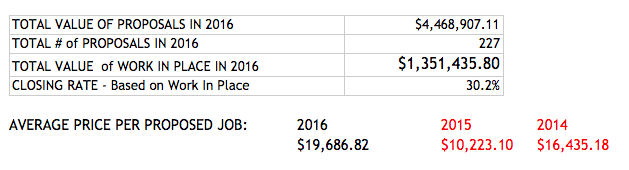

CLOSING RATE

Knowing your CLOSING RATE is valuable information when forecasting the performance of your company in the upcoming year.

In a previous post, I discussed how to track your CLOSING RATE for both the Value of Work Put In Place compared to the Total Value of Potential Work and also the ratio of Actual (Awarded) Projects to Total (Potential) Projects.

A CLOSING RATE based on the actual value of the work is a better predictor of overall sales and marketing performance than a closing rate based on number of projects.

The CLOSING RATE based on actual value will be used to make budget projections for the upcoming year.

(See example below)

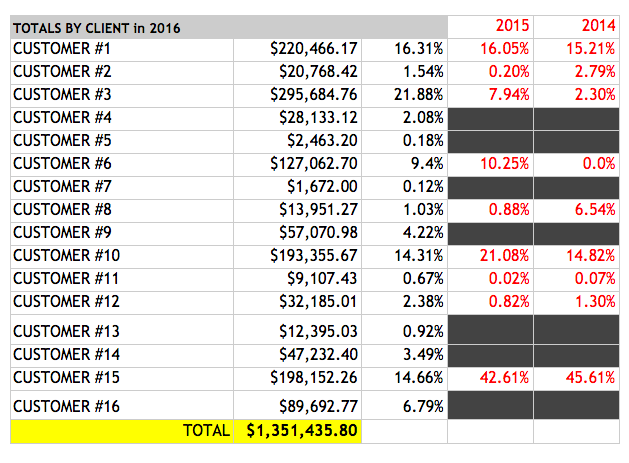

INCOME BY CLIENTS

You want to make sure you know where all your eggs are at any one time, and you don’t want all your eggs in one basket.

Developing this table for your YEAR IN REVIEW will ensure that you identify not only your top clients, but also if you need to diversify your clientele. Every business loves to have those solid clients that they can depend on for regular work. But you don’t want to make sure that you are aware if any one client is a majority of your business. You don’t want to be effective by the ups or downs of another company.

(See example below)

NOTE: Make sure to thank your top clients. Do something special for them.

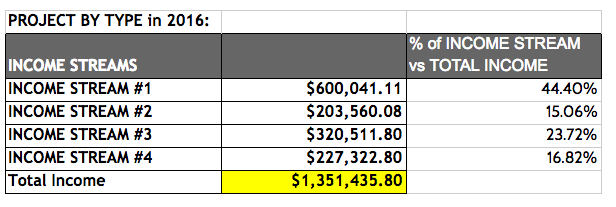

PROJECT BY TYPE (INCOME STREAM)

Most companies make their incomes from multiple sources. You want to make sure that you track these sources of income and review them each year. When you identify your income streams, then you are able to make adjustments during the year that will affect the overall income for your business.

(See example below)

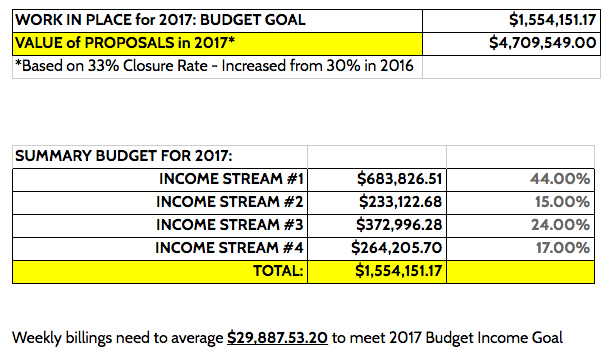

BUDGET: FORECAST & GOALS

The final section for the YEAR IN REVIEW is the BUDGET. In this section, you can set the budget and goals for the upcoming year based on the just-completed-year.

Determine your TOTAL REVENUE goal for the next year.

Do you want to grow revenue by 15% over the previous year, or do you want to keep the revenue the same and increase Net Profits?

Maybe you want to do both?

Whatever the goals are, this is the part of the report where you are going to establish them.

Set a Total Revenue goal for next year.

Based on your Closing Rate, what value of work do you need to propose in order to reach your revenue goal?

Based on the revenue goal, how much do you have to invoice each week to hit that goal?

(See example below)

See this post on developing KPIs and metrics for your business.

The YEAR IN REVIEW will help motivate you to make the changes and achieve the growth that your construction business needs in order to be successful.

If you have been doing your weekly, monthly, and quarterly workouts, then you will be ready for the final lift.

The YEAR IN REVIEW will enable you to start the upcoming year with the end of the year in mind. You will have a plan. You will have goals, and you will know the metrics to get you there.

You are playing the part of Business Owner in this production. Make sure your character is around until the end of the script.

Follow me on Instagram @shawnvandyke, LinkedIn, Facebook, or shawnvandyke.com to learn more about how to streamline your construction business.