Understanding Your Balance Sheet and Profit & Loss Statement

The best way to predict the profits of a construction business is to review the financial statements each month.

Construction business owners cannot guess their way to sustainable profits. They may get lucky from time to time, but that luck will eventually run out.

The only way to run a profitable construction business is to develop a system that generates profits in a predictable way.

The best way to predict the profits of a construction business is to review the financial statements of that business.

And there’s the problem. Many construction business owners do not know how to read their financial statements.

Why would they? That’s the accountants’ job, isn’t it?

As I stated in a previous article, your CPA works for you and should help you make money. Your CPA is not responsible for your profits. You are. Everything that happens in your construction business is your responsibility. That includes the results of the financial reports.

There’s no getting around it. In order to understand the financial reports of your construction business, you have to face the financial reports of your construction business. You can’t ignore them. (Well, I mean you can, but you won’t make a profit and then you’ll be out of business. Let’s not do that.)

In this article, I am going to review two basic financial reports – the Profit and Loss Statement (P&L for short) and the Balance Sheet. Once you understand how to read and analyze these reports, you will be able to develop a system for generating profits and spot trends within your construction business.

REVIEWING THE FINANCIAL STATEMENTS FOR A CONSTRUCTION BUSINESS

Before we get into the nitty gritty details of the differences between the P&L and the Balance Sheet, let’s answer the question:

“How often should I review these reports?”

The simple answer is every month.

Waiting until March or April to find out from your CPA how you did last year is like checking your pulse the day after you run a race. It’s great to know what your resting heart rate is, but that information won’t do you much good after the race. You need to check your pulse while you’re running so that you can make adjustments as you go.

Your construction business has a yearly cycle. This yearly cycle is broken up into four quarters, and these quarters consist of 3 months each. Analysing your financial reports each month allows you to check your pulse while you are still running the race.

Trying to analyse the numbers more frequently than once a month will not allow the bookkeeper enough time to reconcile and compile the data, and reviewing the data sporadically throughout the year will not create the consistent feedback you need to make adjustments.

Rule of Thumb:

Review the financial reports for the previous month on 15th of the current month.

Example:

Review January’s reports on February 15th. Review February’s reports on March 15th, and so on.

(Read this article for more on the frequency of reviewing your financial reports.)

Now that you know when you should be reviewing these reports, let’s discuss what these two reports show.

WHAT IS A PROFIT AND LOSS STATEMENT?

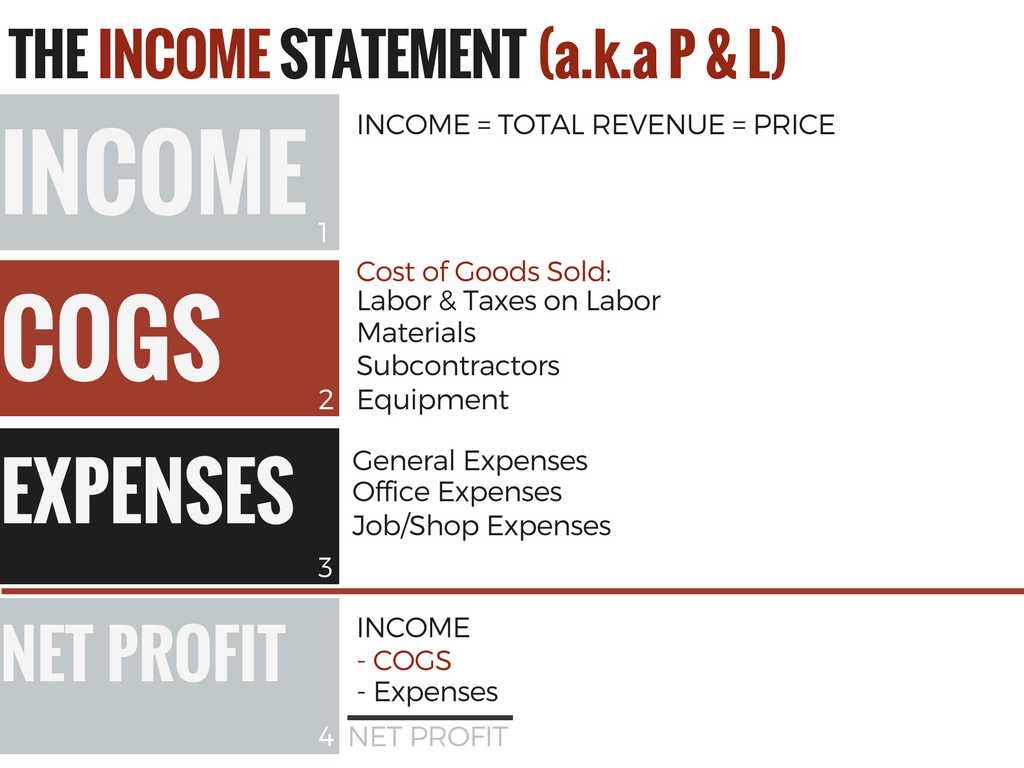

The P&L is also known as the Income Statement. These terms are interchangeable.

The P&L is a summary of the revenues (income), Cost of Goods Sold (COGS), expenses and resulting net profit incurred by the business during a given period of time.

The P&L shows the business’ ability to generate profits.

You can run your P&L for the last calendar year, the most recent quarter, or any period of time in which you want to see what the business did during that defined period of time. The P&L always has a beginning and an end.

There are four main areas of the P&L that show the performance of the business.

These four areas are:

- Income (Revenue)

- COGS – Cost of Goods Sold

- Expenses

- Net Profit

The figure below shows how a typical P&L should look for a construction business.

The P&L is the budget for your construction business and shows the income (or revenue) you have received or will receive and the amount COGS and expenses you have spent or will spend over a period of time.

A PROPOSAL IS A MINI PROFIT & LOSS STATEMENT.

If you think about it, the proposals you present to your customers are a mini P&L statement for their projects.

In order for the P&L to show a net profit on the bottom line, then your proposals (the mini P&Ls) must accurately predict your COGS and use a markup that pays for that project’s portion of your business expenses and leaves you with a net profit . If your individual proposals do not generate a profit, then your business never will.

COGS per project x MARKUP FACTOR = PRICE (of the project)

SUM of PROJECT PRICES = TOTAL REVENUE (of the business)

NET PROFIT = TOTAL REVENUE – COGS – EXPENSES

The main difference between your project proposals and your P&L is that you don’t show your customers your COGS, expenses, and net profit.

Rule of Thumb:

Your construction business should generate a 10% net profit after you have paid all the COGS and expenses. This includes your wage for the work you do in your business.

This is where many construction business owners are losing money. They compensate themselves through an owner’s draw from the Balance Sheet instead of through the expenses on the P&L.

WHAT IS THE BALANCE SHEET?

The Balance Sheet shows much of the same financial information as the P&L, but there are some important differences between the two. First, the Balance Sheet is a statement of the financial position of a business which states the assets, liabilities, and owner’s equity at a particular point in time.

What does that mean? In a greatly simplified explanation, the Balance Sheet shows the net worth of the business.

The second difference between the Balance Sheet and the P&L is the way they treat time. The Balance Sheet summarizes the financial position of the business at a particular point in time. The P&L shows the revenues and expenditures during a given period of time.

Huh?

Think of it this way.

The P&L shows what you are doing during a period of time.

The Balance Sheet shows what you have done up to a point in time.

The Balance Sheets gets its name from this equation:

Assets (stuff you own) – Liabilities (money you owe) = Owner’s Equity

The two sides of the equation always balance.

According to Investopedia:

“It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.”

For small businesses, the Balance Sheet is pretty straight forward. Take the cash in your business accounts, add the estimated market value of any property you own, and subtract all debt and current obligations you have.

For larger businesses, the Balance Sheet gets more complicated and takes a financial professional to accurately prepare.

So let’s keep it simple and focus one area of the Balance Sheet – Owner’s Equity.

Many construction business owners pay themselves through what is called an owner’s draw or owner’s distribution. This distribution comes from the retained earnings of the business, which is accumulated over time by generating net profits. But the owner’s distribution does not show up on the P&L because it is not tied to a business expense. This distribution is accounted for on the Balance Sheet and is tied to the net worth of the business.

And this is a big problem for your construction business.

Here’s why.

HOW TO PAY THE OWNER OF A CONSTRUCTION BUSINESS

You don’t have to work in your business to get an owner’s distribution. You simply have to own the business. You can sit on a beach sipping mai tais and own a business. The owner gets compensated from the retained earnings of the business recorded on the Balance Sheet.

If you do any work inside your business, like sales, design, estimating, project management, lead technician, janitor, bookkeeper, or chief bottle washer, then you should be paid a salary or a wage for the value of that work. Just like an employee would be paid. Employees’ wages or salaries are COGS or expenses. They get compensated from the P&L.

If you work in your business as an employee and don’t pay yourself the value of that work, then the money for that LABOR, whether it’s a COGS or expense won’t show up on the P&L.

If the value of that COGS (field work) or expense (office work) doesn’t show up on the P&L, and the P&L is how you determine the net profits for your business, then your net profits will not be correct.

For example:

Your P&L shows you made a $60,000 net profit after all of your COGS and expenses were deducted from your income.

You worked a majority of your time as a lead carpenter in the field putting work in place, and also worked some time each week “in the office” running the business.

You only paid yourself with owner’s distributions, and those distributions totaled $80,000.

Owner’s distributions don’t show up on the P&L.

If the business generated $60,000 in net profits according to the P&L, but your compensation of $80,000 doesn’t show up on the P&L, where did the money come from?

It came from your assets, most likely, your cash on hand.

How can you make a net profit of $60,000, not charge your customers for the value of the 50 to 60 hours a week you worked in your business and pay yourself $80,000?

You can’t. You didn’t make a net profit, at least not a positive one.

Working this way is one reason why you’re busy with work, but you never have any cash. You’re paying yourself as the owner of a profitable business, but you are actually working as a non-paid employee for an unprofitable business.

FACING YOUR FINANCIAL REPORTS

Understanding the differences between your P&L Statement and Balance Sheet is vital to the financial health of your business. You need to review these reports every month and make adjustments to your operations.

Stop guessing. Start predicting.

…

Thanks for taking the time to read this article. I really appreciate you and value your time. Please leave a comment below if you have any questions about how to determine your markup or how much to pay yourself.

Follow me on YouTube, Instagram @shawnvandyke, LinkedIn, Facebook, or shawnvandyke.com to learn more about how to streamline your construction business. My new book “Profit First for Contractors” will be released later this year. Follow the @ProfitFirstContractor account on Instagram for more information about the release of the book.