The Inflation Reduction Act: A Year of Tax Credit Claims in Review

Discover how American families can benefit from Inflation Reduction Act–enhanced tax credits.

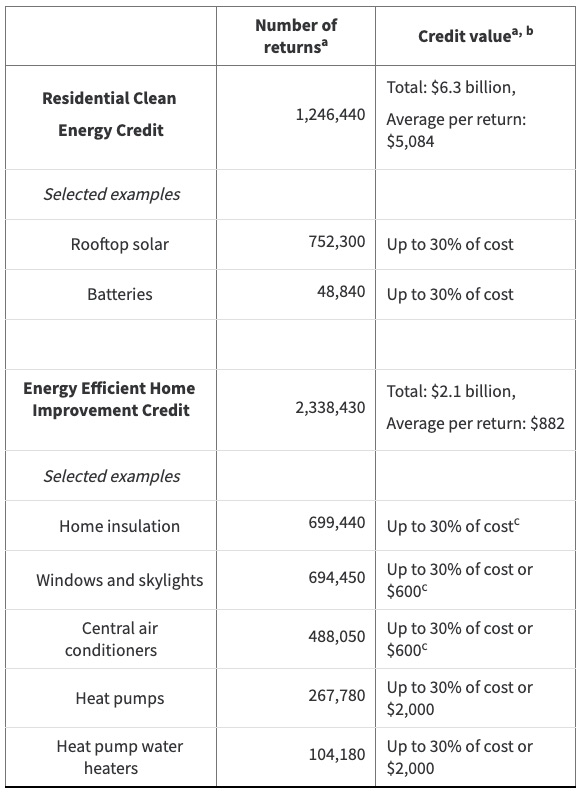

The U.S. Department of the Treasury recently shared an update on the Inflation Reduction Act (IRA), including statistics on 2023’s residential energy tax credit claims, and there’s a lot to unpack. According to the report, “More than 1.2 million American families have claimed over $6 billion in credits for residential clean energy investments—such as solar electricity generation, solar water heating, and battery storage, among other technologies—averaging $5 thousand per family.” At the same time, “2.3 million families have claimed more than $2 billion in credits for energy efficient home improvements—such as heat pumps, efficient air conditioners, insulation, windows, and doors—averaging $880 per family.”

a Rounded to the nearest ten. Preliminary numbers reflecting Tax Year 2023 returns filed and processed through May 23, 2024. Because of limits on the use of the credits such as those described in notes b and c, families may not report all qualifying investments or the full cost of those investments.

b Credit value is limited by a family’s tax liability and other credits claimed. If a family cannot use all of the Residential Clean Energy Credit because of the tax liability limit, they can carry the unused portion of the credit forward to the next year. They cannot do so for the Energy Efficient Home Improvement Credit.

c Energy efficiency tax credits other than those for heat pumps and for biomass stoves and boilers are subject to an aggregate annual cap of $1,200.

Source: IRS, Research, Applied Analytics, and Statistics Division.

Homeowners and America Benefit from the IRA

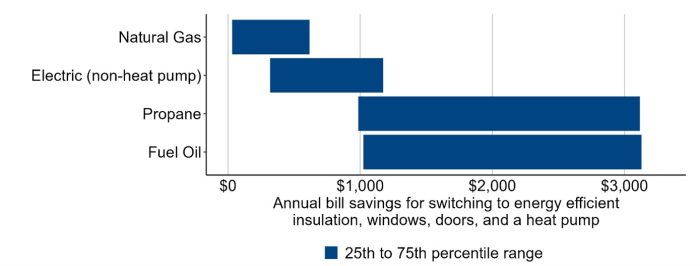

It’s clear that those who take advantage of these available credits will see significant reductions in their monthly utility expenses. Heat pumps are a prime example. They can help save families from $1,000 to $3,100 each year on utility bills. And let’s not forget the environmental benefits of investing in clean and efficient energy. According to the report, “Deploying heat pumps for every household would result in emission reductions equivalent to 330-590 million tons of CO2 per year, or 5-9 percent of current national emissions.”

Note: Figure shows after-purchase annual utility bill savings for switching from various fuel sources (shown on the vertical axis) to an efficient heat pump and improving the building envelope (insulation, windows, and doors). The estimates are only for homes with air conditioning and do not include the upfront cost of the heat pump or envelope improvements. Figure data sourced from the Department of Energy. Original figure reports prices for winter 2021-2022, so values are inflated from January 2022 to June 2024 using Consumer Price Index for All Urban Consumers.

As more homeowners begin to take advantage of the IRA’s expanded tax credits, the positive impact on household utility bills and the environment will only continue to grow. By investing in efficient and clean energy, Americans can help contribute to a cleaner, more sustainable future for all.

RELATED STORIES

- Inflation Reduction Act: Energy Upgrades and Tax Credits

- Residential Energy Tax Credits (GBA)

- One in Seven Families Lives in Energy Poverty. States Can Ease That Burden. (GBA)

RELATED VIDEOS

- A Closer Look at the IRA with Birdsmouth: Part 1

- A Closer Look at the IRA with Birdsmouth: Part 2

- A Closer Look at the IRA with Birdsmouth: Part 3

- A Closer Look at the IRA with Birdsmouth: Part 4

- A Closer Look at the IRA with Birdsmouth: Part 5

Visit the U.S. Department of the Treasury website to learn more.