Any suggestions on obtaining a basic liability insurance policy for home improvement and remodeling projects, I have been waiting on a quote for two weeks with no feedback and its holding me up with work

Discussion Forum

Discussion Forum

Up Next

Video Shorts

Featured Story

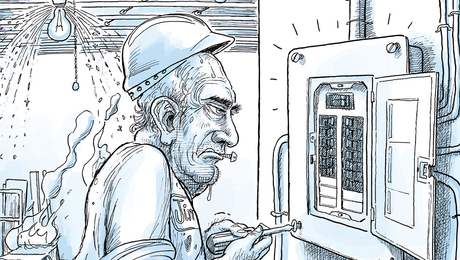

Dangerous electrical work and widespread misconceptions cause fires, deaths, and $1.5 billion in property damage annually.

Highlights

"I have learned so much thanks to the searchable articles on the FHB website. I can confidently say that I expect to be a life-long subscriber." - M.K.

Fine Homebuilding Magazine

- Home Group

- Antique Trader

- Arts & Crafts Homes

- Bank Note Reporter

- Cabin Life

- Cuisine at Home

- Fine Gardening

- Fine Woodworking

- Green Building Advisor

- Garden Gate

- Horticulture

- Keep Craft Alive

- Log Home Living

- Military Trader/Vehicles

- Numismatic News

- Numismaster

- Old Cars Weekly

- Old House Journal

- Period Homes

- Popular Woodworking

- Script

- ShopNotes

- Sports Collectors Digest

- Threads

- Timber Home Living

- Traditional Building

- Woodsmith

- World Coin News

- Writer's Digest

Replies

Waiting for a quote? I walk in and buy mine on the spot.

I get around 1 mill liability coverage for $6 or $700.

Doug

what type of info you give them to give you such a low quote they gave me a quote of 1400.00

If you do any roofing it drives the rate up.

Manuel, If you want to be protected by the insurance that you purchase, explain the type of work that you do to the insurance agent. They will have different rates for different classifications of work. I think interior carpentry is one of the cheaper classes. For contractors the rate will be much higher.

Insurance companies can and do refuse payment of claims if you were doing work outside of your stated classification.

Manuel

I'm in Iowa and I do mostly interior trim/cabinet/built ins. I'll have to take a look and see what the company's insurance name is, not coming to me right now.

I know the type of work that is performed has some bearing on what the insurance costs, I'm assuming that I probably land in the low end for liability/risk.

Doug

I get around 1 mill liability coverage for $6 or $700.

that'll get you about 6 weeks worth here in So. Cal.!View Image “Good work costs much more than poor imitation or factory product†– Charles GreeneCaliforniaRemodelingContractor.com

that'll get you about 6 weeks worth here in So. Cal.!

Yea, I knew my costs would be considerably cheaper then the coasts.

I only buy liability ins. as a part timer, small jobs. I work for someone so I don't need it for that time, only when I do side jobs. I'm sure I'm getting pretty cheap rates due to all these circumstances.

Another guy I work with gets about the same amount of coverage for about the same premium, and he does some small additions.

It's probably hard to compare our insurance costs due to regional differences. Your costs for doing business out in California are considerably higher then mine in Iowa. That's something the OPer needs to consider.

Doug

I guess they figure there's too many lawyers here in Ca.! Liability is higher, worker's comp is higher. But then the overriding majority of smaller contractors doing handyman and remodeling work out here are unlicensed and uninsured. View Image “Good work costs much more than poor imitation or factory product†– Charles GreeneCaliforniaRemodelingContractor.com

But then the overriding majority of smaller contractors doing handyman and remodeling work out here are unlicensed and uninsured.

Oh, we dont need a license either!

Doug

Yeah, look up insurance in the phone book. I am a small carpentry contractor, max crew 3 or so. I pay $1200CDN or so. I need it to do some government projects.

check out Erie Ins if they're in your area.

ask about the 5 Star Contractors policy.

Jeff

Buck Construction

Artistry In Carpentry

Pittsburgh Pa

What Jeff said. Erie, hands down.

In my state the only one to write it at reasonable rate is Farm Bureau, 720.00 a year. For the State min, Oh by the way as my agent said never file a claim.

Wallyo

Just got a new policy thru Country Insurance (Used to have Am. Family, but they got out of the contractor insurance business). I think it runs about $800/yr & that includes some tool insurance. I'm in MN.

Mike

Arcticcat,What kind of coverage do you have? 1,000,000?Jeb

Yea, I think it was only like $48/year to go from 600,000 to a million.

You got Country?

Mike

Based on my current experience, I would urge you to get a general insurance policy as opposed to a liability policy.

With a liability policy, your insurance company may claim that you must have knowingly committed a significant mistake before they will pay.

That potentially leaves you in the position of relying on the homeowner to collect their insurance so you can get paid.

"Based on my current experience, I would urge you to get a general insurance policy as opposed to a liability policy.With a liability policy, your insurance company may claim that you must have knowingly committed a significant mistake before they will pay. That potentially leaves you in the position of relying on the homeowner to collect their insurance so you can get paid. "What is the h*ll is "general" insurance.Each type of insurance only covers those those types of loses that are specified..

.

A-holes. Hey every group has to have one. And I have been elected to be the one. I should make that my tagline.

An auto liability insurance policy, as opposed to a general policy, excludes paying to fix your car, if you cause the accident. But it does cover damage to another vehicle.

Your rates are cheaper because your car is not covered. Full coverage with a general policy costs more.

Liability insurance for general contractors, is cheaper than general insurance, because the company won't pay unless the contractor knowingly made a mistake.

Try that last statement again.

"Liability insurance for general contractors, is cheaper than general insurance, because the company won't pay unless the contractor knowingly made a mistake."Liability policy only pays for the for what the contractor is legally liable for and if that is covered by the policy.Although in many cases the cause and liability is clear enough and the insuance company will pay with having to go to court.But it has nothing to do if he KNOWING makes a mistake or not.For example if he leaves some oily rags in the house and the combust and burn down the house it he does not NEED TO KNOW THAT WAS A MISTAKE fo rthe liability insurance to cover it.Now I have no idea of what you are talking about comparing this to car insurance.WXACTLY WHAT DOES GENERAL INSURANCE COVER..

.

A-holes. Hey every group has to have one. And I have been elected to be the one. I should make that my tagline.

mauel--hands down---Erie Insurance

If you work solo----look into seeing if they still offer an "Artisan" policy---- I had that at one time----practically free

I have the 5 star contractors policy now----quite reasonable

Its definitely time to find a new broker- one who is a bit hungrier for some business.

Edited 4/1/2008 11:09 pm ET by texemay

in NYS it is hard to get liabily ins. and very expensive.

Aquote of $1400 is very good from my experience.

People who have responded, he probably can only get one ins. co. to

write him. The ins. market is very difficult in NY. That quote may very well be for an artesin policy.

You may want to check with agent about what is taking so long.

To give you an examole, I have a home builder friend that paid over

100000 for policy. He only built 3 houses. It has become insane.

If you think that is high, wait until you have emolyees and have to buy

workmans comp.

50 cents on the dollar paid for roofers, carpenters around 22 cents for each dollar paid.

M,

We pay about $2,400 for $1m in GL coverage. I think this is on a gross of ~$800k.

That's the thing about trying to compare insurance policies- you have to find out what the sales volume the policy is written on to compare rates. At least in this area, you could pay a few hundred on a GL policy if you're doing a small volume or tens of thousands if you're big.

I would find another broker, or at least nudge the current guy along a bit more firmly.

Jon Blakemore

RappahannockINC.com Fredericksburg, VA

Manuel,

I pay about $900 annually for 1 mill coverage through state farm.

I recall when starting out, it was tough to get a policy underwritten, due to the lack of an experience rating. The companies want you to have experience in the business, before they will write the policy. The problem is that you need the insurance to get the experience. Nice!!!

As other have said, the difference between 5-600K and 1 mill. is usually pretty small. I know even here in the woods of NE Wisconsin, 5-600k might not cover the potential loss on alot of the houses. Some of the lake home I work on, the 1mill is probably not quite enough.

Might be time to go see my agent!

Brudoggie