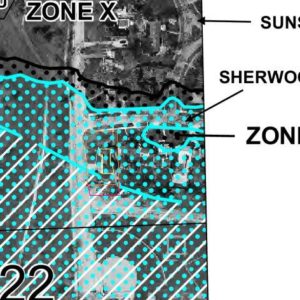

Debby and I have been looking at houses in Fort Wayne. One that we like very much and can afford is in a flood plain. Attached is the FEMA map with the house outlined in yellow. The approximate property is outlined in red. I’m not clear where the southern boundary of the property is, so I drew a second line to indicate the two most likely candidates.

It is not clear what Zone the house is in. The southern end of the property is Zone AE, but the house is just outside that.

The house is 64 years old.

I saw no evidence of any water damage anywhere in the house.

I saw no evidence of the basement having water in it.

A neighbor of 40 plus years said the worst that anyone has had in his memory is a couple of feet of water in the basement.

We plan to do more research, but I thought I would see what anyone here might have to say about the idea.

Replies

check the insurance rates, my second home, with the national flood insurance, went from 1400 to 400 after I raised it 32".

When we looked at houses in Kansas the ones with trees all around them were in lower areas.

Having trees all around your house makes ALL the difference.

they tended to be in lower areas. Personally, I'd risk some water for it.

Will Rogers

Looking at your map. If you get a mortgage, you WILL be required to get flood insurance. It will probably be higher and in addition to your house insurance.

BTDT

Hi Rich,

I'm gonna play stooopid here......they call it a flood plain for what reason?

Got any family nearby that'll take you in when it does flood?

Gonna scream Uncle Sam save me when it floods?

Any more nearby development going to be going on later that'll shed more water into your area?

Is it a haven for beavers waiting to happen and are you going to pay for the population control?

You'll save $ now but how much sleep will you lose?

Good friend bought a house.....I don't exactly remember all the details......something about the exchange of property and some odd thing about 30 days for flood insurance to accrue or some strange thing......he bought the insurance but something about closing that it wouldn't protect for 30 days after closing......sorry for this part of the rambling......but 28 days later he had 2 ft. of water in the house from a hurricane......no insurance coverage on the 500k home.....cost him 150k out of pocket for repairs.

Your $ please don't ask for my tax dollars to bail you out with a bucket.

Pedro the Mule - with love

There is a river not too far off.Interesting point about the thirty days.If we buy it, we will pay for flood insurance.

go to your basement with a laser. sit it up at 2'. now swing it around. does it really matter once it floods 2' if it floods 8'? no it's just a big mess either way.

when you check on flood ins and find out it's a 1k plus a year, ask them what it covers. nothing below ground level. so after paying all that money over the years,it floods 2' in basement,it's your baby to fix,no insurance will cover below grade.

find another house,then you can sleep on the nights it's raining.

the older i get ,

the more people tick me off

No insurance covers below grade? That's interesting.I think it would take a truly massive flood to get water above grade.

thats their plan,really think about it. if there is only 6" of water standing around your house,your basement is full to the joist.

dam water levels itself!

ask the question,but thats how it was about 8 yrs ago when i looked at a house in a fp. doesn't cover anything below grade, so that pretty much gets all the mechanical systems etc.the older i get ,

the more people tick me off

It will probalby cover lowest framing member up and 1 entrance if on pilings.

so buy the house...

just get the sellers to throw in a boat with the deal...

Life is not a journey to the grave with the intention of arriving safely in a pretty and well preserved body, but rather to skid in broadside, thoroughly used up, totally worn out, and loudly proclaiming

WOW!!! What a Ride!

Forget the primal scream, just ROAR!!!

Is that the new map or the old one ?

They are in the middle of the process of changing over right now...

There's a pretty good mess of regulations that goes along with being/building in a floodplain. (what you can build/ or not , how it's built, etc.) The list of regulations is ever growing - larger everytime I go to do something...

The insurance thing is an issue all of itself. I aint paid in years, so I'll forgo stories.

All in all, it aint that big of a deal on a daily basis, just annoying every now and then.

Remodeling Contractor just on the other side of the Glass City

I believe it is a new map. I seem to recall it has a 2009 date on it somewhere....But I could be mistaken.

I can't tell much from that map - no key or index infor.Flood zones are variable - which is 100 year floor, which is ten year flood and which is surge zone?I barely found the house - seems bordering grey area between crosshatch lines, blue spots, and black spots, whatever they mean.What know about flood zoner building is that the living floor must be one foot above the high water level indicated on map.So on the caost here, you might have a high tide flood in a sheltered area that is seven feet up, and a quarter mile away a surge zone where it runs to 19'And there are spots within a marked flood zone where the building site is higher than that indicated. Takes a surveyor to establish how high your living floor is above or below the pertinent flood level.Don't forget, some of those levels are the engineering corps best guess estimate and all those guesses have been turned on their heads latelyGood luck

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

The new "map" isn't in effect yet...

2009 doesn't mean too much. Just trying to give you a heads up that they are changing the rules as they make them. They have the authority to "administer "the FEMA program through laws already passed.

Now the "adminstration" runs willy nilly with each shift in politics and lobby meeting.... hold on....

Been in a fp for 20 some years, I've seen how high the water will ever get around here. The regs stack on each year without a major reason.

You're wise to ask upfront - that piece of land that you envision building a shop on...? May be completely disallowed - doesn't fill the FEMA regs...10 yrs ago I had to build my shop in two phases because the day I went to pick up my approved permits - they remembered that it was FP - "sorry cant build it"...had to build half of it, then put on an addition of the other half. That was 10 yrs ago. Now, no way I could swing the "funny business". and it's getting worse. Way worse. Remodeling Contractor just on the other side of the Glass City

The top of the flood zone indicates the 100 year flood level, i.e., the peak level of a hypothetical flood that would occur once every 100 years. So it is a risk, but maybe not a big one, that you have to compare to the cost of flood insurance.

If that is the new flood map, you may want to compare it to the old one to see which way they are predicting the 100 year flood line is moving.

I have been building a second home in a flood plain for several years now and there are several issues that you need to weigh before jumping in (so to speak).

Many people think I am nuts for building where I did, but, I have close knowledge of the flood history of the area. I have records from family and friends going back almost 70 years of not just the flood elevations, but how the other homes in the area fared during floods, and what the rate of rise and fall of the water levels typically was.

My home has no areas below grade and it has flood vents on the drive under garage level. The highest recorded flood elevation is about 3 ft above grade so I have poured concrete walls the extend a foot above that, and then the main floor (living space) is another 4 ft above that.

All mechanical systems are 5 ft above grade.

The lot has had high water in two fo the last four years with one getting 6" deep in the garage. As long as you know what the possibilities are and plan for them it really isn't a big deal. No one on the entire penisula where I am has ever incurred a loss due to flooding but we all prepare for it well. We store anything that can be damaged up high.

Can it be nerve wracking at times, sure, and I have had a few times where I couldn't use it due to high water but I don't regret it at all. This was the only way I would ever be able to afford to build on the lake where I vacationed as a kid.

I don't carry flood insurance and I know that I have a big risk there, but I also have gone to great lengths to research and plan for the various issues that could come up.

It's certainly not for everyone but If you can plan and prepare for the worst case scenario and accept the risks going in, I don't think it is a huge issue.

I do know that if we ever get a flood that is worse than the 100 year historical data I will be in far better shape than any other house in the area. Most have them have been there since the late 40's early 50's with no real isssues so it was a risk I was willing to take.

How many steps to get up to the front door?

13 I think. Less if it's flooded and I can drive up in a boat :).I have canoed down the driveway before.

Rich,

Find out how much the flood insurance will cost for sure. i.e. get quotes on that property.

Divide that into monthly portions. Add that amount to the total payment that you'd pay on this house. That's the true amount that you'd be paying on this house (since the insurance would be required).

Now, using a mortgage calculator, figure out what price home you could buy with the same monthly outlay that didn't require flood insurance.

Remember that costs such as insurance will likely go up over time. The terms of the mortgage are fixed (I HOPE!!!).

AND a good percentage of the population avoids property that requires flood insurance, a factor that will impact the ultimate sale of what you buy now. I know that from 14 years in the real estate biz.

Add in the risk you personally take to deal with a flood if it happens while you own the property. It'd be costly, insurance or not.

"since the insurance would be required"Only if he finances the house. I don't know his situation but not everyone has to do that.

Of course.

Houses are drastically cheaper in the flood zone because of flood insurance requirements if you borrow money to buy it . They often look cheap but they are no bargin . Meaning they will never high sell with comparables ever.

The best situation with what you describe is to own the home out right and borrow money on somthing else . Then you may have hazzard with out flood if yiou are comfortable with it . Then as the car expression goes drive till the wheels fall off . Buy it and stay there and you made a good buy . But dont expect to have a good sales prospect. They are not . They normally run 15 to 20 percent below market for a safe in the flood zone house .

Tim

I looked at some lots down the street, Went to city hall , looked at the flood plain map saw they were in the flood plain.

I have seen the entire lot underwater several times from high tides, rain and beaver dams.

Another person bought the lots dug down in dry July and built a spec..

That winter water came up in the crawl space almost to the joists but still over the traded sill and untreated girder wall.

The drain spouts from the roof would not empty as the water level was to high.

Ponds were in the yard.

The septic is under the water table so the pump is pumping 24/7.

Rather the sell it and be builder liable hes pretending he is living in it to off load this lemon on some rube.

NEVER buy anything in a flood plain or by a River!!!!!.

No dont do it!!.

PASS!!!!!.

RUN!!!!!

Sounds like someone at the building dept wasn't doing their job. There are many regs about building in flood zone and I don't think many of the issues you describe would be occuring if FEMA guidelines were followed.

Well its a very long story but suffice to say the map said unbuildable. The lots were worth almost nothing . But To someone else in town they magically became build able.. The map saying unbuildable was replaced with a painting. Long story short, Buyer beware, do your homework on anything.

There is a whole master plan community called Natomas in Northern Sacramento, Ca.

Thousnds and thousands of homes were built and sold. Then, the flood plan maps were changed to include the whole area. Everyone got hit and now are forced to have flood insurance and the banks require it.

Funny how the gov't, and city, "probably" knew that this area has been prone to flooding over the last 100 years.

One problem in the Sac area is that the dikes were always assumed to be forever safe, and now, from years of neglect plus more water coming down the river, they're threatened.

As I stood before the gates I realized that I never want to be as certain about anything as were the people who built this place. --Rabbi Sheila Peltz, on her visit to Auschwitz

"Funny how the gov't, and city, "probably" knew that this area has been prone to flooding over the last 100 years."I wouldn't be that suspicious.A LOT has changed ion the past hundred years and I don't mean climate. developement and agriculture have changed the lay of the land, the flow rates of rivers, and the paths they follow. There are places where land has risen and places where it has sunk nearly twenty feet

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

All bad properties get sold to someone from away. The locals never buy it.In this case, Rich is from away I think

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

Not all. I bought mine knowing up front the issues and knowing the history going back 70 years with family and friends owning the property right across the street.

general principle, not cast in crete

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

Yeah, and we all live under the sky - chicken little....

There aint nothin' wrong with livin' on the water - just know that you do. And what's involved. Rich is smart to ask. He'll be fine.

Remodeling Contractor just on the other side of the Glass City

Well it only takes once . And someday YOU have to sell it. Given a choice between high and dry or wet and wild i will put my chips on high and dry and pay a fair price.. The people in the back are running through the swamp busting up beaver dams. Not how i wanna spend my weekends

You can't tell sith from a FEMA flood plain map, other than there MIGHT be a problem, and flood insurance WILL be more expensive. A place can go 100 years with no problem and then be flooded 3 years in a row (especially if someone changes drainage patterns upstream). A place theoretically outside the flood plain can be flooded, while places 10 miles upstream inside the flood plain are fine.

What you do want to (try to) assess is whether the threat is for low-level flooding (because you're sitting in a wide flood plain, and not 10-20 feet lower than most of the rest), or rather it's for high-level flooding (because you're in a relatively narrow valley, or in an area that's 10-20 feet lower than most of the surrounding).

(This is where having a few surveying skills and detailed contour maps can come in handy. To the untrained eye the land may appear flat, even though there's 25-50 feet variation over a quarter mile.)

Also assess what the tendency is for flash floods in your area.

Low-level flooding is a PITA, but (if low enough) may spare the main floor on a raised-foundation structure. Just be aware of the danger and avoid having an enormous investment in the basement. Also, consider having some defensive measures (berms around the house, stockpiling sandbagging supplies, etc). If you're in danger of high-level flooding (a danger which is much increased if flash floods are a threat) then the entire structure is at risk.

In either case, assess the integrity of the foundation. Many homes that would otherwise survive with minor damage are severely damaged when basement foundations collapse from water pressure, or pillar foundations are seriously eroded by floodwaters.

Have the floor elevation verified by a surveyor in the area, using the latest datum available that is approved by your municipal codes or Army Corps of Engineers. I've seen elevations as much as 5' off because they used photogrammatic contour maps instead of an actual physical survey. Have the notes recorded at your court house so they may be accessed as public records by insurance carriers.

All that cerification is good for is that day. Like someone else said it can change if it ever floods . Happend to a bunch of folks in LA. Still no gaurentee but enough to buy a house I reckon.

I've done sheetloads of flood plain surveys. The 25/50/100 year elevations come from the USCGS through the Corps of Engineers surveys which are usuallyn "samples," meaning that they fly photogrammerty over fixed points of known elevation, or use GPS the same way. These points are usually tied to a perpendicular section of a creek/flood plain usually a mile or less (to encompass the extreme elevations of the flow line and higher elevations) and about a mile apart. A lot can happen elevation-wise in a mile.

You also have the incursion of impervious cover (houses, roads, parking areas) that weren't present before and will affect the "Q" (total runoff) and turn a placid little creek five years before into a raging torrent with 6" of rain NOW.

The impervious cover information is supplied to the USCGS by State, County, and municipal entities along with any other factors that may affect downstream volumes and velocities, and plugged into their calcs to achieve an elevation for a particular area usually bounded by a line that can vary up to 2-3' on a standard 2' contour map. That's what a lot of lawmakers use to set the "flood plain" limits. Structures within the area are usually slated for physical observation of their floor elevations, porvided the funds are there. If not, you gotta do it yourself...

The survey certification means a lot more than that. A map may indicate that a house site is one foot below the high flood level, but if the surveyor finds that it is in actuality not below, but one foot above there are hundreds of advantages, most revolution around the fact that it is far less likely to flood, but also the legal stuff, in that it is what is actually on the ground that counts, not a map that was prepared using some amt of guesswork.In most places, to build in a floor plain, there are cost adding regulations that must be followed. If you don't, you can't get a permit or can't buy FEMA insurance. We simplified the process here to avoid having to enforce all those rules for constructing in flood plains - here you just can't bui9ld in a flood plain period.But there have been two times I personally was involved, where it was possible to show that the house site was in fact higher than shown on the maps, making it possible to build.

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

I think you two misunderstood my point .

A flood cerification is good for the day it was written and you get it in the mail a week later and its prepaid . They will not gaurentee its good the day you get it in the mail. You cannot sue them over it except that day you didnt have .

ou must be talking about something else for sure then.Iam referring to the survey the licensed professional takes from the Datum mark to certify at what elevtion your site is.You record that and it is good for eternity or until it is not there anymore

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

The mark is there yes . Flood certification is only good for the day its dated. By the time you recieve it in the mail its out dated. We use that for legal reference when its not . No one will stand behind that certification past the day its written. Im not talking about the mark of elevation.

There were a lot of people in Katrina that held a flood certification 4 ft under water. Thats a verifiable fact. They went to get it out when the insurance would not pay hazzard . The people cried that they had a flood certification. Good for you but were still not paying . They werent tied to flooding at all and thats why they looked to Fema but they didnt help them either .

The people were looking for someone that had done the wrong . They had been required to provide a flood certification when they got their house loan and pay hazzard insurance . They did all that and were not covered!

Tim

So you are talking in reference to the pitfalls of insurance claims where the ccompanies look for any out exceuse.I'm talking about verifying elevation at location for purpose of being able to get a permit to build in the first place.

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

I think what you and Tim are talking about is called an "elevation certificate". It has to be done by a engineer or surveyor.

They are big in determining your flood insurance costs.

Im saying a flood cerification will allow a permit or a loan but after the day its written , its not worth a cup of coffee if you want to enforce anyhing or personal insurance to your self . Its no gaurentee of anything .

I got what you were sain the first time .

must be a difference in State laws.

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

I dont think so.

You just have never been bit by the devil of it .

You got a state law that calls it differently. Unless you do its your baby.

No Southern state I know of is any different . I did quite a bit of study on it . One time it was my job. Im tellin ya , its how LA got screwed. I studied that too.

Tim

Edited 8/21/2009 7:52 pm by Mooney

Edited 8/21/2009 7:53 pm by Mooney

My house is in a flood zone. I bought it in 2002. The first floor is about five feet above the ground, over a crawl space. There are no utilities in the crawl space. In 2004 we got a flood. About four feet of water in the crawl space. I waited for two days for the water to recede, while my family and I (wife and three daughters) stayed at my parent’s house.

When I went in to the house it had dampness to it, but no smell. I brought a dehumidifier and borrowed a second one and proceeded to dry out the crawl space. It took about four days. The only damage I had was I lost a GFCI outlet on the outside by my deck, my trashcans floated away and I ended up with a ton of debris on the lawn (part of the debris was about 60 pieces of fire wood).

In 2007 we had another flood. This time it was much worse. As the water started to rise I went in with a boat and some of my daughters friends and placed all the furniture we could lift on to paint cans. Good thing I saved all the paint cans I brought since I owned the house.

We got about five inches of water in the main floor. I saved all my furniture, which was good because my insurance did not cover contents. The total damage was about $65,000.00. The insurance company gave me about $45, 000.00.

My flood insurance started out at about $600.00 a year and has gone up to $1400.00 a year. I added $10,000.00 of contents coverage, about $100.00 a year.

The Insurance coverage for flood is written for the insurance company. Nothing below grade is covered. I had hard wood floors with wall-to-wall carpet. The carpet was original when I brought the house. I had planed down the road to take it out and sand the wood floors. The insurance company paid for the carpet to be removed, the wood floors to be removed and the subfloors to be removed. They also paid for the subfloors and the carpet to be replaced. They would not pay for the hard wood floors to be replaced because they said we were NOT using them. They will also only pay to have my bottom kitchen cabinets replaced and not the uppers, because they were not damaged by water.

In my area (North Jersey) all floods happen in the spring, ironically around April 15th.

I always looked forward to spring, now I am always apprehensive when the weather gets warm. I usually don’t sleep much during the month of April. I have become very good at monitoring the weather. My wife says I can smell a flood. The land does take on a marshy air when a flood is pending. You must always monitor the weather, mostly past rainfall. The soil conditions always dictate a flood, not just rainfall.

Do you really want to buy a house in a flood zone?

Everything you say is correct - pay attention, Rich - except that Flood Insurance isn't "written for the insurance company". FEMA are the ONLY folks that sell Flood Insurance, they do it through the insurance companies. But the guidelines, rates, rules, etc. are from FEMA. Same house, same coverage, the cost will be the same, no matter who you buy it from.Used to be a 7 day waiting period, but it was changed by Federal Law to 30 days after the Mississippi River floods of 1993. People downriver ran out and bought coverage, and as long as they held on for 7 days, they had coverage.Piffin is right, as he always is - a Registered Surveyor can determine the Lowest Floor Level, the level above sea level, and even a 2 foot difference above the mapped Flood Level can result in hundreds of dollars less premium.And Sbds is correct about what is covered. FEMA Flood Insurance covers ONLY ACTUAL DAMAGE. If floor joists are determined to be damaged by termites, not covered. And Flood Insurance does NOT cover the typical Additional Living Expenses that your homeowners policy does. Have a fire ? You get an allowance for lodging, laundry, etc. Flood ? Nope.Greg

(Licensed Insurance Agent, probably 200 Flood Policies in force)

Wow. Great discussion!! Thanks!I'm hoping to get to our insurance agent tomorrow. We need to move fairly quickly here as the sale of our house seems to be moving along pretty good (inspection is passed, appraisal tomorrow).

If you are still serious after all this you need to hire your own agent that can only represent you and you both sign the agreement . That locks you two up kinda like a lawyer. Doesnt cost anything but it makes them serve you and they cant serve in their own listings. Because you deny it by the agreement just like if you buy in their area you have to deal with them.

Now have that person do an mls search for comparibles and their knowledge should be adequate about the adresses dealing with flood zone houses. It will let you know where you are at for sure. No guessing .

If I were buying in another area I would certainly do it unless I were buying a repo. Id probably still pay them money for their expertise and their knowledge of the town.

Edit ; Pick an agent with lots of experience . Meet them first eyeball , and make your decison after asking some questions covering their knowlege inadvertenly.

Tim

Edited 8/21/2009 12:00 am by Mooney

"If I were buying in another area I would certainly do it unless I were buying a repo."My understanding is that this house is not a repo per se, but that the bank is in complete possession. I believe the owner(s) gave it to the bank without the foreclosure process.I suspect the owner lost a lot of money. Lots of work has been newly done in the kitchen and the roof was removed from the very large two car garage and a huge master bedroom with large full bath and two large walk in closets built on top of the garage.I do hope to get a bit more of an idea of what the house is worth. It is assessed at 247,600, but for sale for 149,900 which was 154,900 a month ago. I have to think the assessment is too high.

That's comparable to the price drop I've seen in the Louisvile area -- roughly from $250K to $150K. Thankfully things have been a bit more stable here in tropical southern MN.

As I stood before the gates I realized that I never want to be as certain about anything as were the people who built this place. --Rabbi Sheila Peltz, on her visit to Auschwitz

Looking at the house in Google Earth, it appears you are only about 600 feet north of the river, and the house lot is about the same elevation as the nearby riverbank. And from the Google Earth info, which looks like it was taken in the summer, the river is only about 15 feet below the bank. In the spring it would likely be higher.

So if this Google Earth info correctly describes your topography, I would say away from this house. You are just too close to the river. If the river would ever overflow, you would immediately be under water.

ok educate me ,how did you get all that from google earth. all i get is a map that will show a aerial and thats it.

must be alot more info than i know about. thanksthe older i get ,

the more people tick me off

Don’t confuse Google Earth with that map that pops up when you Google an address or business. Google Earth is a separate, but free, program that you must download and install. I use version 4.3 for the Mac.In Google Earth, I placed the street names that were provided (Sunset Dr, Sherwood Terrace, and Hartman Dr) and the program identified an area. I just scanned around and found an area that matched the provided map. Then I scaled in to the particular house.If you place your cursor on an area in Google Earth, the elevation shows at the bottom of the screen. Now I don’t know how accurate that elevation is but I suspect that most authorities, like FEMA and the county land office, use this remote sensing for setting the flood plain. As others have mentioned, it would be wise to get a real surveyor on the site to get very accurate elevation data.

I checked Lake Michigan on my Google Earth (V 4.3.7284.3916). It showed the elevation at 528 ft, whereas Wikipedia shows 577 ft.

Jon Blakemore RappahannockINC.com Fredericksburg, VA

Google Earth places Cedar Flat, CA (on the shore of Lake Tahoe) about 4 miles off its real location; about 2 miles east, instead of 2 miles west, of Carnelian Bay. I shouldn't expect its elevations to be very accurate.BruceT

We got the insurance quote today. $1,925 a year. It is considered to be in zone AE (since a portion of the property is, it all is). That's $160.42 more per month which really makes the house more expensive than what we're looking for. For the moment we have made an offer on a different home, but we'll see how that goes.Someone told us that the entire neighborhood is trying to get the flood zone changed since the city has done a lot of flood mitigation work in recent years.My brother points out that there is no incentive for the government to change flood zone designations in a way that would lower premiums received.

Zone AE is the most restrictive, it's in the floodway. You pretty much can't put any structure in the floodway.

I don't know if it's a federal regulation, but at least in Mass., you cannot improve a house by more than 50% of its value unless you bring it up to the latest flood standards for the zone. That could mean raising it on posts in some cases.

Next is the whole "it hasn't flooded since I can remember" false hope. 1% chance of flooding in a given year is about a 1 in 5 chance of flooding sometime in the next two decades. If it hasn't flooded in a while, you might consider yourself overdue. Last year and the one before, I recall reading about a lot of "500-year" floods occurring around the country.

If the maps have not been updated and you were in what would have been Zone X under the current maps (really old maps may have other designations), you can get insurance at the current rates and they will be grandfathered after the new maps go into effect. However, if you've already been quoted $1300/yr, then you're probably in Zone A in the current map.

You may also add fill before an area becomes Zone A, but not after. If all parts connected to you house (foundation plus attachments like a deck and stairs) are above the base flood elevation (BFE) before the new maps go into effect, you can get a survey and request a map amendment for your house to remain in Zone X, which is all that matters for flood insurance.

http://www.floodsmart.gov has lots of info. The toll-free number actually had helpful people on the other end who could answer detailed questions on the spot.

My property will be rezoned from X to A next year under faulty mapping. My surveyor shows the front half of my house is above the BFE, but the LiDAR maps from FEMA taken by airplane say the whole neighborhood is Zone A. LiDAR is accurate to about a foot they say. My survey to prove I'm out has to be accurate to 0.1 foot.

The back of my house is 6" below the revised BFE. I don't think water could get to the backyards because our block has a higher sidewalk, so the area is not continuous to the river, but FEMA won't do any actually surveying except near the floodway. I put a raised bed garden next to the house and filled under the deck and put pavers in place. After my survey, which I need to pay myself, I'll have Zone X rates.

By the way, if you're in a flood zone and not about to die, get insurance, even if you don't have a mortgage. It covers all the serious floods. Homeowners doesn't cover any, except maybe basement coverage at an exorbitant amount.

Aint no bargin now is it ?

You could buy 162 per month more payment house and pay less insurance .

Thats why they are cheap but no bargins .

Yup. That's the way of it.We've made an offer on a different house and it was accepted. I expect I'll be living in Fort Wayne in five to six weeks.

Good luck

Yeah, G erth shows my house to be about a half mile away from here

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

Are you sure your house is on the right property?

Actually, I think it locates by street adress and the town adressing is hoakie

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

It's right on my computer, both Google Earth, and Google maps.

What's right on your computer?Not the location of Cedar Flat. For the 55 years that I have known it, Cedar Flat has been just west of Carnelian Bay on Highway 28, not in the woods north of CB.BruceT

It seemed to jibe with other maps like this one from the USGS.

Why are you so determined to "prove" me wrong?Maybe that USGS map is where Google got their wrong information, but I own a house in Carnelian Bay where I have spent parts of 61 summers and 12 winters. In that time I have driven passed Cedar Flat and seen its official CalTrans sign (on Highway 28 about two miles west of Carnelian Bay) at least 600 times. I know where Cedar Flat is.

CalTrans knows where Cedar Flat is.

Google does not.

BruceT

Apparently, Googles source is wrong. I have found Google maps to be very accurate though.

Map people do things like that so that if another company copies the map it is easy to prove.

Purchased our current home in a A7 flood zone. Another thing to keep in mind if you ever wish to do projects outside which will require a permit, AC, propane tank, shed and so on, you will need an engineer involved for the certification of flood elevation forms and others. Its a another big expense and extra time on simple projects.

Had water twice, once a vacuum clean up, the other about 1". FEMA insurance is worthless for small floods. It would cover furnace and AC and thats it.

Not sure I would purchase again in a flood zone. The houses on the street all had water that spring storm, so I am sure this is going to effect resale values.

Kevin

Rich,

One more thing you need to know - when you build that shop, you'll have to have a SECOND, distinct Flood Insurance Policy. Of course, it's only REQUIRED if you borrow money on the building. If you pay for it as you build it, no one can tell you that you HAVE to carry Flood Insurance.

Greg