OK. You can stop laughing now. I know you can’t answer this exactly.

But here’s my real question. I was looking at my home’s insurance policy, and I realized we haven’t increased our coverage at all since we bought this place ten years ago. We bought the property then for 200K and insured the structure for the same amount. Since then, the property has reached a value of around 600K. According to our tax assessment, the land is worth 500K and the 60 year old house is worth 100K.

How much should I insure this place for? If it burned down, we would want to replace it with another small, frugal house. Our new house would ideally have a full unfinished basement, two stories, and hopefully an attic. A simple roof line. Three or four small bedrooms and two full baths. No fancy finishes anywhere, but not a cheap slapped together house either. Hardwood floors on first floor, carpet upstairs. Vinyl floor in kitchen and baths.

We currently have 1300 sf of finished space, and with the unfinished basement and attic, around 2600 sf of total space. To fit closer to more modern standards, I think we would probably look for a new house with around 1800 – 2000 sf of finished space plus an unfinished basement.

So if you were in my situation, how much would you insure this home for? Oh yeah, this is Arlington, Virginia. Right next to DC. It’s not cheap here.

Thanks!

Replies

My insurance policy automatically adjusts for inflation every year. If yours does too, you might already be insured for more than you think.

If you insure it for less than 80% of it's value (At least according to my policy) there are penaties if you have a loss.

You probably need to check with your insurance agent and see what they tell you about local laws and your policy.

Thanks, Boss.Well, we just got the renewal statement the other day in the mail, and the coverage hasn't increased in ten years. I plan to talk to my agent, but want to have some idea what rebuilding a house will cost when I talk to him. I could just make wild guesses, but have no facts to base them on. Can a basic home still be built for 200k? 300K? 400k? The property is worth 600K, but you've got to be able to build a basic house for less than that.

I thought that most home insurance policies had inflation protection built in. That's something you should maybe ask your agent about. I don't know anything about construction costs in your area. Maybe smoeone else can chime in and adress that.

All reformers, however strict their social concience, live in houses just as big as they can afford. [Logan Smith]

You know, maybe it does have that inflation coverage built in. I'm sure I paid close attention when I bought the policy ten years ago, but I can't remember what was said. But the statement I just reviewed had the original coverage listed, not a higher adjusted amount.

One thing I've been told is you want a policy that has "replacement cost coverage".

That way no matter what it cost to rebuild, you're covered.

You could take that money and build a "better" home, but the difference would be paid by you of course.

My insurance policy automatically adjusts for inflation every year

That jogs my memory, mine does that as well. However, it's (my policy, I think) only adjusting from the 1999 sale value for insurance--which is not the same as present-worth replacement value (I think--will take some gazintas tonight, I do believe).Occupational hazard of my occupation not being around (sorry Bubba)

you can build a Katrina cottage on your land for 49k

I'm in Arlington too and had the same discussion with my agent. (It came up because I looked into adding a 16x20 addition on the back which was going to cost more than my whole house was listed for on the tax apraisal which was supposed to be market value.)

He had no clue what building costs are around here, but insisted I was fully-covered. Yet when I looked into the numbers, I found out I was substaintially underinsured--when they issued the policy 5 years ago, they backsolved a sq ft size for the house that is less than half the size of my home to get a "value" equal to my purchase price!

Numbers I've been told lately here for new construction are $200+ a sq ft for a simple structure. Estimates I've gotten on a "simple" addition (no baths-1 story, rectangle, w crawl space) with some upgrades are closer to $400+ a sq ft- note however this an addition and would have a few extra costs to tie it to the original structure.

Hope this helps.

This is pretty helpful! Thanks.Now I'm depressed though. It sounds like I'm very under-insured.

glatt... based on your description of what you would replace it with.. and guessing at costs in your Arlington area...

i'd be looking at $300K +/- to replace it ( structure & landscaping ) your contents and appliances would be separate

there would some demo costs..... but your utility fees are paid....

1300 sf footprint might be 32' x 40'..... and you did say smallMike Smith Rhode Island : Design / Build / Repair / Restore

Excellent. Thanks for that. A roughly 30 x 40 footprint is what I had in mind.

my house was 28x 40, three years ago, no labor, no kitcern cabinet, it cost me $49,980 in material only, no labor

You don't insure land, only improvements. If your current house is indeed worth only $100k, you're going to have a large argument over a claim for twice (or more) that much.

Va law requires the assessor to come up with a fair market value. As this is the only thing they do, you might think they'd be good at it. Sorry, it's really hit and miss (often by a wide margin), in my experience. You do need to determine current value of your house and insure accordingly. From that $100k, I think I'd spring for an appraisal.

Sounds like you're trying to insure a non-existing future house. Home owner's insurance doesn't work that way.PAHS Designer/Builder- Bury it!

Good point. I can't expect insurance to pay for a mansion if all I own is a shack. But if I'm fully covered, won't insurance pay for a new house of the about the same size and quality but built of new materials and built to modern codes? Such a house would be worth more than my 60 year old house with an aged plumbing system and an old roof. That may seem unfair to the insurance company, but you can't build a new 60 year old house. They don't sell 60 year old pipe at the plumbing supply place, and you can't buy old shingles either. The government won't let you build a new house that's not to code.

can you post a few photos of your house ?

outside and inside ?carpenter in transition

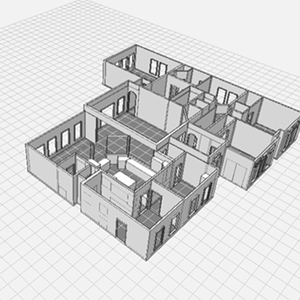

Don't have any pictures, but it's really nothing special. It's a Cape Cod built out of hollow concrete block, coated with stucco, and then later covered with aluminum siding. The siding is aged and not very pretty but keeps the water out. The roof will need to be replaced in the next few years, as will the gutters. The second floor walls are framed, but have no insulation. There is insulation in the attic.Not much workmanship in it, as it was built right after WWII in the big housing boom around here. It does have some nice plaster walls, and hardwood floors downstairs. Worn out carpet upstairs. We re-did the kitchen, and that is pretty nice now with new cabinets and corian countertops. New appliances. Retrofitted central air. Original radiator heating. Updated electrical box.It has 3 bedrooms (2 upstairs and 1 downstairs) and 2 baths, and a nice sized kitchen. Big unfinished basement.It's nothing special, but it's our home.I just remembered. I did mess around with Sketch Up a while back and made this picture. It's not exactly to scale, but pretty close.http://www.flickr.com/photos/glatt/136536339/

But if I'm fully covered, won't insurance pay for a new house of the about the same size and quality but built of new materials and built to modern codes?

That's what you're hoping for. Certainly reasonable. Now make sure that your insurance contract specifies that. Which is what we're really talking about, the contract between you and the company.PAHS Designer/Builder- Bury it!

Tom,

I'm sure we're on the same page here, but I just want to clarify:

A real estate appraiser is rarely if ever used to determine replacement value of a structure for insurance purposes. Real estate appraisers are used to determine value of the property for its sale.

Replacement valuation needs to be done by someone skilled at evaluating the actual cost of replacing or rebuilding the structure after a major loss. Our office does this occasionally for a fee. A qualified builder in the area could provide the same service.

Sounds like you're trying to insure a non-existing future house. Home owner's insurance doesn't work that way.

We're in agreement here. If I were this homeowner, I would get an assessment from a local GC for what the rebuild cost of the structure and foundation including total demolition for the building exactly as it stands. 60 year old homes generally have a lot more detail than you might think, and if the house has plaster, you must take that into consideration.

Homeowner's insurance is the least expensive insurance you can have out there. Selling yourself short by saying "I only want a small, sparse house if I have a major loss" is really foolhardy.carpenter in transition

A real estate appraiser is rarely if ever used to determine replacement value of a structure for insurance purposes. Real estate appraisers are used to determine value of the property for its sale.

We're definitely not on the same page. An appraiser's job is to determine market value. Period. Not for a sale, not for a loan, just market value. A professional will not distinguish. And I'm not suggesting that appraisers are always the professional paid for. I know better.

I've been in situations where appraisals are necessary. It's the only resort. Ask a builder? Which one? That doesn't work. That is the job for an appraiser. The only job. I gather you are one. What is it that you do for your fee? Make the lender feel comfortable? Hope not, I've seen that. Very unprofessional. Market value is the answer.

Sorry, seems to be a very different opinion here.

The insurance contract probably calls for replacement in like kind. It's the insurers' business to know what that will cost. There's no other way they can manage their risk. They have to replace current market value. No more, no less. PAHS Designer/Builder- Bury it!

The last appraisal that I had, about 15 years ago) had 3 ways that it was evalated. One was adjusted comps and another was replacement cost using some stanadardized cost forumlas..

.

A-holes. Hey every group has to have one. And I have been elected to be the one. I should make that my tagline.

tom.. all true... but what is really happening here is INFLATION

he has $100K insurance... based on his purchase price

so let's say ( just for arguing .... )

when he bought it the land was $50K & the house was $50K

now the land is appraised at $500K

i can easily see the house replacement value going to $300K - $400 K

when we built our first house we spent $27K for everything

today if that house was bulldozed and i was hired to rebuild it.. i'd have to charge about $350K minimum.. even though i might save the cost of the septic (doubtful ) and sure the cost of the well ...

appraised market value may even be lower than the replacement value...

market value is what someone will pay in current market conditions

but replacement value is what the contractor will charge to replace it

now.... one has to follow reason.... but i ASSUME Arlington ,VA has high construction costs similar to ours here in RI..... and his description says to me that no one is going to replace it for $100K.... or $200K

with my insurance company ( USAA ) they have formulas for replacement costs and variables for geographic differences...

i'm sure GLATT can get the same deal from his insurance co.... they are in the business of insuring.. and setting the proper replacement value is in both partie's interestsMike Smith Rhode Island : Design / Build / Repair / Restore

appraised market value may even be lower than the replacement value...

market value is what someone will pay in current market conditions

but replacement value is what the contractor will charge to replace it

It's the insurer's job to know what replacement will cost. And schedule premiums accordingly. As you mentioned, that's the job of managing risk, the only thing insurance companies do.

The other side of the contract, the home owner, needs to know that replacement will actually occur. A major part of that is understanding what the current market value is. Whether from the tax assessor or an appraiser.

The actual cost is a burden on the insurance company, not the HO. The HO's job is to make sure he's fully insured, if desired. That's where market value comes in. The actual replacement cost is not the HO's business. Not to suggest he shouldn't be interested/concerned, but it's out of his realm.PAHS Designer/Builder- Bury it!

The actual cost is a burden on the insurance company, not the HO. The HO's job is to make sure he's fully insured, if desired. That's where market value comes in. The actual replacement cost is not the HO's business. Not to suggest he shouldn't be interested/concerned, but it's out of his realm.

Tom, whoa, hold on a second. You are living in a dream world if you think that your local insurance agent is the person best equipped to determine replacement cost value of your structure. Especially the specialized structures that you build. And as far as trying to hold your insurance carrier responsible in case their replacement cost guess is wrong ? Fat chance.

Most HO's rely on their agents to put a replacement cost on their home because they think their agent should know best. After all, they do it every day, right ?

Let's take my home, which is a perfect example. My agent is a personal friend, well respected in the area. The home was built around 1915 and can be seen in the attached photo. Stone water table, double wythe brick construction, wood lathe and plaster, hardwood floors, stained oak cabinet head trim first floor, same trim in cypress on second and third floors, ceramic tile on mudbed in bath, gas fired steam heat with cast iron radiators, connected single car garage, slate roof, etc.

View Image

My home is about 2200 sf. My agent visited my house and suggested insuring for $185,000.

That's $85 per square foot.

I wouldn't even call that a near miss. I have it insured for $385,000 and I doubt that's even enough to put it back the way it stands.

The average homeowner would have just trusted him at $185,000. And it is the homeowner that is on the hook for the wrong number. The replacement cost IS the homeowner's business. Few policies guarantee replacement of the structure no matter what the cost.

Insurance repair work represents 70-80% of what I do. I have seen so many underinsured homeowners that it makes me want to cry. The homeowner has a beautiful brick home like mine and they end up with a vinyl box in the end after a major loss. In our area, I'll bet at least 60-70% of all homeowners are underinsured.

Here's the problem: The agents are in a competitive business and they want to beat the price of the next agent. An easy way to do this is by reducing the insured value of the house.

The best solution for this is to have a contractor do a replacement cost estimate on the structure. It doesn't have to be a stick by stick estimate, it can just be a cost per square foot estimate.

Once you have this number, you can then shop HO insurance and look at the premium cost. The HO then has to decide, can I afford a policy which will rebuild my house exactly as it stands ? And then, do I want to put it back just the way it is ?

This is where the appraisal of the house can come into play to help each individual HO determine which level of coverage is right for them. The appraisal number should only be a final check in the picture.

A close friend of mine is a perfect example in this case, her home's rebuild cost is about 6 times its appraised value due to a high level of detail in the home. That appraisal number does play a role in her coverage decision.

Insurance companies pay based upon replacement value not market value. Market value is meaningless to the insurance carrier.

carpenter in transition

Edited 5/25/2007 11:55 am ET by timkline

Very thorough analysis, Tim. The 2004 Hurricane season, then Rita, Katrina, Wilma - not to foget Hugo, Andrew, and the Oakland CA fires all changed the way property insurance policies are written. Companies used to compete for your business with promises, then when they had to deliver, they realized their policy language was just too generous. People were using their homeowners insurance as a maintenance policy.

Nowadays, they use some fairly sophisticated software to determine actual cost to rebuild. Sure, they miss the mark in a lot of cases, but it's pretty close. Has absolutely nothing to do with local market value, and the value of the lot has nothing to do with it. In most states, they go for that full cost to rebuild and they have a 15% safeguard built into the calculations. Several states require that the insuror allows an additional 25%. Unless it's an older policy or contract, full replacement value is just not sold any more.

Greg

In 2003 I lost my home during the southern california wildfires, (Cedar Fire). The reality is that a vast majority of fire victims here learned they were significantly underinsured. On top of that, insurance company adjusters were quoting ridiculous, (for San Diego area), costs per square foot rebuilding estimates. The costs ranged anywhere from $100-$300+ per square foot to rebuild, (for me it was about $140). Yet insurance adjusters were offering in some cases as low as $30 per square foot to rebuild. Of course type of construction and materials used as well as grade of appliances, floors, finishes etc varied the cost of construction. The State of California Department of Insurance had to get involved in several instances of insurance company misbehavior as well as mediate untold hundreds of disputes. Then there were...and still ongoing...lawsuits; with win/losses on both sides. However many insurance companies did admit that underinsurance was a problem and have changed the way they write policies and the coverage amounts. In California at least, there are no more,'guaranteed replacement' policies anymore. Instead they have a premium plan where they will pay a percentage above your base coverage to cover any excess construction costs. In my case the insurance company paid 150% excess of the base coverage. Beware the math too! The interpretation is that 150% is really 50% over the base cost since in their mind, 100% was already paid for the base coverage. Its more convoluted than that but I won't bore you with that. They also try not to pay for things as porta-potty's, temp power and light,etc....The bottom line here was that insurance companies said it was the duty of the policy holder to notify the insurance company of the true cost for replacement/rebuild of the dwelling. They actually successfully hid behind that premise.

As for the initial question. I paid about $300K for 1944 sf, 3br, 2.5 bath, 2 story plus a full partial finished basement, stucco exterior, full tile floor on entire house, (brrr in cold), 9' ceilings, GE Profile appliances, Hanstone countertops, Moen fixtures, Toto toilets,comp shingle roof, dual zone hvac, fire sprinkler system-mandated by county and fire inspector. I used alot of my contents coverage to finish the house and credit cards to furnish it.

Yet another pitfall is the limitations in some policies that will only pay a certain % of total coverage for mandated code upgrades. In the case I'm now handling, the house was on the ocean, built on concrete piers about 11 feet above sea level. The new code required the house be another foot higher above sea level, costing about 200K, substantially more than the available coverage for code upgrades, which was only 10% of the house coverage. The homeowner had to eat about 125K just for raising the floor level.

Just one last thing from lessons I learned during my dealings with the insurance companely after the rebuild. Document, document document...Think about how you will prove to the insurance company what you had before it burned down. Remember they will not automatically pay the full coverage up front and walk away after handing you a check. You will need to complete a scope of loss and describe in minute detail from floor to ceiling every bit of construction detail your home had. Tile floors, crown moldings, marble countertops, etc etc etc. The last thing you want to do is let the insurance company tell you what you had based on their records...or worse yet in the case of unpermitted additions...based upon county/city records. They will only pay for loss amounts you can prove. Also you need to insure what you actually have. I had 2 unpermitted bedrooms, (didn't know they were unpermitted until the fire), so the county thought I lived in a 950 sf 2br house-wrong! Fortunately my insurance company was very cool with it. Anyhow, get a camera or camcorder and take lots of pictures, overalls and closeups, think details that you want remembered, (you don't have to rebuild exactly what you had, but that is what your base claim will include in your scope of loss...and it all adds up). Don't forget to document your possessions too!!!

Julio

You are living in a dream world if you think that your local insurance agent is the person best equipped to determine replacement cost value of your structure.

Tim, reread what I wrote. You're distorting, I hope unintentionally. But you're a long ways off from what I said.

I clearly differentiated between value and replacement cost. Makes no sense to try to combine them. Not the same thing at all. Surely you know the difference. Can you spend $400k building a $300k house? Of course.

Nowhere did I suggest that an agent determine the replacement value decision. If you recall, I suggested an appraisal. That was your original error, thinking that appraisals are only for a sale. They're not. An appraisal is appropriate whenever anybody willing to pay the fee needs to determine market value.

Insurance repair work represents 70-80% of what I do.

Which still doesn't tell us what you do. Other than apparently not appraising. I also guess you aren't an adjuster.

Your friend apparently didn't get a very professional appraiser. I've seen that. My first experience was one on a grossly underpriced house. Appraisal came in $500 over the contract price. Here, that's called appraising-by-contract.

Appraisers are no different from any other trade. Some are good, others aren't. Difficult to sort out? Of course, just like GC's, who will give very different sq ft costs for the same house. As you will most definitely find if you follow your suggestion.

Read the insurance contract. It clearly says what the insurance company's obligation is with a claim. Replacement is not unusual. That cost is something the company needs to be very well aware of. Has nothing to do with the agent, he's a salesperson. The agent doesn't set the rate either. You're confusing the salesperson with the company. It's the company you deal with on a claim, through an adjuster. You should already know this if you've involved with the process.

The HO's job is to ensure he's adequately covered. "Adequate" being the HO's managing his risk. Full, partial, whatever. It's a continuum.

Frenchy seems to prefer partial-coverage. The HO's you've encountered you believe were undersold coverage, as you believe was attempted with you. Certainly possible they were, but it's their job to determine. As it is yours, as a HO. Are you over-insured? Under-insured? I have no way to know. That's your job. And you don't seem to know either, saying: I have it insured for $385,000 and I doubt that's even enough to put it back the way it stands. Or... like frenchy, you're deciding to pay lower premiums and assume more risk. Nothing inherently wrong with that.

I base my choice of HO coverage on my outbuildings and liability. We all have different needs. The agent should aid you in determining coverage. Mine does. I hope yours did, otherwise he didn't earn his keep. It goes beyond the dollar figure on the house.

A small for-instance. Guy down the road here experienced a catastrophic loss of house. At the fire he was proudly telling everyone that it sure was fortunate he'd recently bumped his insurance up $100k, more than doubling the coverage. He was grossly over-insured. And he didn't collect in full from the insurance company. That was an instance of the agent doing exactly the opposite of what you seem to believe is common. It also was wrong, and unsupported. HO used every trick in the book to try to collect the face value. Didn't happen. Eventually they reached a compromise cash settlement.

BTW, what I build is the simplest of commercial construction. Extremely uncomplicated to determine cost. Value is considerably more difficult, but the last appraisal sure made us ecstatic. 50% over the cost. As it was an appraisal to enable financing, unlikely it was over-stated. PAHS Designer/Builder- Bury it!

Tom,

I work for a large commercial construction manager / general contractor. I am a project manager in an arm of the firm which does a lot of insurance related property repair. Prior to this I was a union carpenter foreman in the same division for 18 years. I evaluate property damage, write detailed repair estimates and manage this work. I also manage residential and light commercial remodeling. You can see the company website here:

http://www.butz.com

Let's say that we were neighbors and friends and I knew you were in the building business and I knew nothing of construction. You knew my house, the one pictured and described above. If I called you and said, hey I just got a new homeowner's policy for my home, but I have no idea if I am properly insured. You're in the building business,

what recommendations do you have for me to be sure I am properly insured ?

carpenter in transition

Is common for insurance policies to have a separate line item for demo. Also for landscaping (but it is often minimal).Of course contents and living expenses are also seperate items..

.

A-holes. Hey every group has to have one. And I have been elected to be the one. I should make that my tagline.

glatt,

Do you want to sit back and watch it all happen or have one built for you? The difference is giant!

For $100,000 my friend built a 4000 sq.ft. energy efficient home, himself!

He bought surplus (and returns) windows and doors for less than 1/4 of what a lumberyard wanted and incorporated them into the house design rather than build the other way.. He timberframed the house and used Sawmill wood rather than lumberyard wood and spent $6000.00 rather than the typical lumberyard price of $45-50,000 His brother did all the brick work and he poured the walls with ICF's.. From the time he tore his old house down until he had it weather tight it was a month but it took him 2 years of evenings and weekends to finish off the first floor.. the second floor is empty.. just walls up no need to finish but it cost him $9200 to build the second floor but added well over $100,000 to the finished value of the house..

Context frenchy. keep it in context

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

You need to carefully look at your policy. Up to several years ago, many Homeowner's policies provided for guaranteed replacement cost coverage. That coverage, usually included in an endorsement, is not any longer available in many locations. What most people have now is an endorsement that provides that is the house is destroyed, it will pay the insurance amount (Usually called coverage A) plus some percentage in addition, if needed to replace the house. However, the only way you get more than the coverage A amount is if you actually spend the additional money. You also need to look at the policy language to see who is responsible for making sure that the house is adequately covered for replacement cost. Most policies have a cost of living escalator, but after many years, it may not have kept up with inflation.

I am in the process of settling a dispute among a homeowner, his bankruptcy trustee (my client), his insurance agent and insurance company. What I learned has caused me to look carefully at my own policy.

Well, I'm glad I'm looking at this now, instead of after needing to file a claim. Amazing how much changes in ten years. Should have been looking at this more frequently though.All the rest of you reading this, do you have enough coverage on your homes? Better to check now.

You also need to look at the policy language to see who is responsible for making sure that the house is adequately covered for replacement cost. Most policies have a cost of living escalator, but after many years, it may not have kept up with inflation.

Another item for my checklist, tonight <sigh>.

Hmm, bought 1400sf for $60k; insured to $69K. Estimated worth on today's market, $93K (assessed by county for $76K and climbing <sigh>).

$93k/1400 = $66/sf± <ick> 1400 * $150/sf = $210k <eek!>

Boy, do I need to do some gazintas . . . Occupational hazard of my occupation not being around (sorry Bubba)

We built a modular cape cod in Arlington 18 months ago. We finished one story with 2bd2ba, plus 1000 sq ft upstairs unfinished, and an unfinished basement. It cost us about $220,000, which included site work, the foundation, and the house. Custom built with a full second story in Arlington would probably be a lot more.

PS House is 28x46

Edited 5/24/2007 1:15 pm ET by mforbes

One thing to beware of is the thought that, " I built it myself for only $XXX, with no labor cost, so I only want to insure it for $XXX"

Problem is, do you really want to do it again ? While your family waits ? Living in a rental apartment while you try to make a living, then go work on your own house when you get off ?

This is one time you want to be well insured. A good policy will cover replacement of the dwelling and full replacement on the contents with brand new stuff. AND living expense coverage while you're displaced.

Note: FEMA flood insurance does NOT cover living expenses.

Greg

Greg,

You make an extremely valid point. No one can fault you for your logic,, except!

we live in the real world..

I live in just such a house,, worth millions if the recent appraisel by the bank is to be believed.. now while some of that is the land, a serious chunk of that is the homes value. I've spent every spare minute of my life for the last 6 years and will spend another 3 getting this place finished..

If I insure it for the millon plus it's worth I simply cannot afford the premiums. OR I can have a giant deductable and lose what insurance is really supposed to afford me that is the ability to weather minor damage. The first $20,000 is deductable.. makes the premiums affordable.

So do I risk the $20,000 loss or the total loss of the whole thing? Can any insurance that you cannot afford be worth while? If I give up what I've spent a decade of my life working on is insurance a value?

It's the real world.

Hey, Frenchy -

The real world application for a unique, period home like yours is a Stated Value Policy. To calculate the full replacement value on a home like yours, a one-of-a-kind timberframe, or a unique Victorian, or most any home over 100 years old . . . the figures will stagger you. The typical Victorian, with plaster and lath, high ceilings, heart pine flooring, etc. can run the estimator tool up into $ 1 million, plus.

In our real world, the insurance gets unaffordable real quick.

Most major companies have a Stated Value Policy. They might call it something else, but it's based on an agreed-upon amount that satisfies both parties. The contract states that a partial loss will be fully covered, but in the event of a total loss (fire, tornado) the most the ins. co. will pay is $XXX, the agreed amount.

This sort of contract shifts some of the loss potential back to the homeowner, but the savings can be considerable.

Greg

Edited 5/25/2007 9:31 am ET by GregGibson

Well, gee, thanks--now I have to go dig up my homeowner's policy.

Probably a good idea, even if insurance-ese is among the worst verbiage to wade through . . .

Shoot, I wonder if I have enough coverage for less-than full replacement. That would be a bear, adjustment says repair, but no budget for it. Dnag it, another set of numbers to cipher up. Well, at least that'll keep me out of bars for a while <g>.

Just buy a replacement value policy instead of a dollar value policy, and get it appraised and document any speccial features that add value above typical for house that size.

Welcome to the

Taunton University of Knowledge FHB Campus at Breaktime.

where ...

Excellence is its own reward!

Just buy a replacement value policy instead of a dollar value policy, and get it appraised and document any speccial features that add value above typical for house that size.

Good advice, but remember that most insurance companies do not write guaranteed replacement coverage any longer. Companies like Chubb may be an exception, but the premiums may be unrealistic. As others have pointed out, the cost to replace an ornate Victorian or other special situation may be far higher than the actual fair market value. As an example, yesterday I received my annual renewal policy and premium. The coverage A limit is at least double the fair market value, but a reasonable approximation of what it would cost to duplicate the entire house.

Basically, we all need to make sure that the coverage is adequate and it keeps up with inflation in the building market.

Don't count on your agent/broker to take care of this. Their position in litigation when a house burns down without enough coverage is that "it wasn't my job to make sure coverage was adequate." That sounds ridiculous, but some courts have concluded that unless there is a specific agreement to take responsibility for making sure coverage is adequate, ("special circumstances of assertion, representation and reliance" Rapp v. Lester L. Burdick, Inc., 336 Mass. 438, 442 (1957)) an agent/broker has no duty to the insured to do that.

I'll have to check mine again now.

State Farm - it is supposed to be a replacement value type.The islands here have had some troubles with HO insurance for two reasons. Onbe is tht replacing a house on an island is 15-30% higher than the book shows. The other is that many fire departments are undertrained, understaffed, and under-equipped and have no effective corabarrating agreements with neighboring towns

Welcome to the Taunton University of Knowledge FHB Campus at Breaktime. where ... Excellence is its own reward!

From my experience in Northern Va I would suspect that cost of $200 would cover wo story, $250 for single story with same square footage.

Generally fire insurance has a co-insurance clause that provides the 80% coverage requirement. The import of this is that if you carry $100 of insurance on a $200 structure, and have a partial loss of $50, then because you were insuring only one-half of the value, the insurance pays one-half of the loss.

As long as your are reviewing your insurance consider "upgrade" coverage. My son had a $100,000 fire and the furnace and water heater, though unharmed, had to be replaced because of current building code requirements. His insurance covered the upgrade to code.

Hope this helps.

Bill

Well, after reading the policy and number crunching, I'm both good and bad. Good in that the policy covers more than I thought, and less than I expected (and might have missed without smlaw's "heads up").

What hit me though, was one of the numbres. See, 1400 @ $140/sf is $196,000--not a bad price, all in all, for a ground-up rebuild. The problem is that's double the value almost anywhere on my street and nearby neighborhood. That warrants a harrumph, I think.

In some ways, it's as bad, if in the reverse way, of "losing" a unique house, like the previously mentioned ones. So, I'm covered if the house burns, but that leaves me with the question of how to rebuild in a $60-70/sf range.

Rather annoying to think that, after a catestrophic fire, I'd be better off finding a similar used house on the market, and then selling "my" land as an infill lot. That rather irks my sense of neighborhood in ways I'm not sure I can express correctly.

But, it also does not help suggest any answers, either (which also irks). Will take more thinking, I imagine.Occupational hazard of my occupation not being around (sorry Bubba)