I’m in the middle of a remodel. To say I have the worst timing would be an understatement.

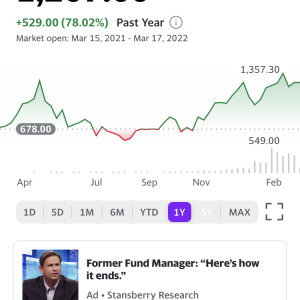

I have been watching lumber futures on yahoo finance and I’m wondering if anyone can explain how the future contracts on 1000+ board feet will correlate to the price tag on the shelf.

Obviously a higher futures price means higher shelf price, but how does the timing correlate and does the futures price apply to a month, quarter, day, etc?

What data can I pull from this to know when lumber prices are going back to their “normal” price and not $8 for a 2x4x8’?

Replies

This is probably not the best topic for this forum. Given the trillion$ that the Feds have printed, don't expect a big return to 'normal' pricing. The value of the dollar has been drastically diluted because of this.

Yah I figured maybe some homebuilders who live or die by material pricing would have some insight.

Last fall the prices did go pretty close to “normal”.

We’ll see

Anybody that had that crystal ball wouldn't be building houses, they'd be on the beach drinking umbrella drinks. I've gone to percentage pricing so from that perspective I don't care where prices go.

You made me look at the value of the dollar charts. Maybe there’s more variables that you know of.

https://tradingeconomics.com/united-states/currency

There are many things that affected the price of lumber in the last couple years.