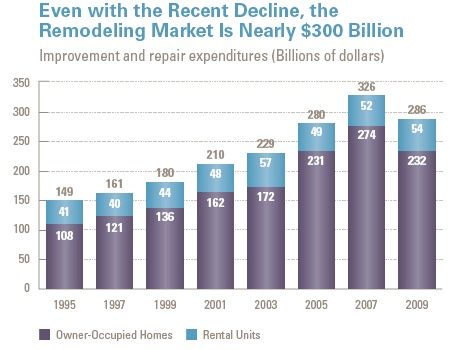

Even with recent declines, the remodeling market is nearly $300 Billion

Although increasingly encouraging prospects for remodelers have been highlighted in Fine Homebuilding a few times in recent months, a comprehensive analysis released early in the year by the Joint Center for Housing Studies of Harvard University offers a much fuller picture of the economic forces at work in the remodeling sector, and indicates that remodeling may have some of the housing industry’s sturdiest legs.

Titled “A New Decade of Growth for Remodeling,” the JCHS analysis is presented as a five-part document, with accompanying tables. It draws on U.S. Census data, the Census Bureau’s American Housing Surveys, and other sources to describe the remodeling industry’s characteristics and performance over the past decade, including its relative resilience during the downturn, and its prospects for the decade ahead.

On average, the study notes, homeowners spend more on residential improvements than do owners of rental properties, although remodeling spending by both types of client is expected to increase at rates that will significantly exceed sales growth in the homebuilding market.

Remodeling’s headwinds

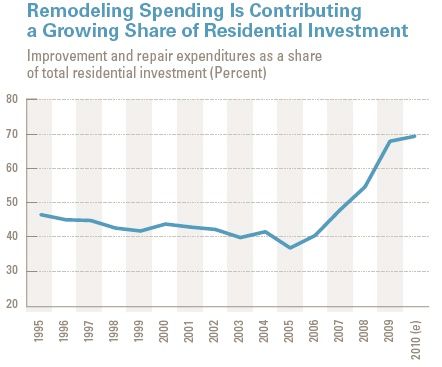

To be sure, the economic slump – with its housing crash, avalanche of defaults and foreclosures, depressed sales prices (which in most markets are expected to slip further over the next 8 to 12 months), and unemployment struggles – has created stiff headwinds for the remodeling business as a whole. The industry peaked nationally in 2007, then fell 16% by the end of 2009, the JHCS analysis shows. Still, historical patterns of residential spending indicate remodeling is likely to continue to find favor over homebuilding during the next half decade: in tough times, remodeling’s share of total residential investment tends to rise against spending on new construction (likewise, when spending on new construction is robust, remodeling’s share of residential investment tends to fall).

Over the next five years then – as residential construction continues its crawl back to recovery – remodeling activity is expected to attract the bigger share of all residential investment, JHC analysts say. Not surprisingly, housing’s economic turmoil has bred demand for remodeling services among homeowners who, even though they may have lost equity in their homes and lost mobility in the housing market, are starting to regain enough economic stability to contemplate improving the house they have, often with systems upgrades and energy efficiency improvements rather than, say, discretionary remodels of kitchens or bathrooms.

The notion that remodeling is on the upswing also was affirmed by the National Association of Home Builders’ Remodeling Market Index (RMI) readings for the first quarter of 2011, which showed the overall RMI increasing to 46.5 from 41.5 in the fourth quarter of 2010. Even though an RMI below 50 indicates most remodelers report activity has dropped from the fourth quarter to the previous quarter, the overall reading does incorporate “future remodeling activity,” which includes calls for bids. That category also rose, to 46.8 from 39.7, over the same period.

Signs of resilience

Part 1 of the JCH study, its Introduction and Summary, points out that the remodeling industry took in almost $290 billion in 2009 – well below the $326 billion peak in 2007 but nowhere near the crash-and-burn declines seen in new residential construction. In fact, the maintenance component of remodeling expenditures, an historically stable category even during downturns, increased slightly in 2007-2009.

In spite of the recent downturn, from 1995 to 2009 remodeling spending has increased in general and, on average, absorbed 40% to 45% of total residential spending. And even though overall remodeling spending decreased from 2007 through 2009, spending on remodels of rentals actually increased during that period as many would-be homeowners – and those who lost homes due to foreclosure – stayed renters or became new tenants.

A fragmented industry, with a concentration of activity in big metro markets

Remodeling is still dominated by self-employed special-trade contractors (43%) and self-employed general contractors (24%), the JCH study notes, although consolidation is becoming more common in some trade categories, such as among exterior-replacement specialists and insurance restoration contractors, that can benefit from scaled-up business, production, and purchasing operations.

Geographically, the level of remodeling activity tracks closely to markets whose residents have relatively high incomes and relatively expensive homes. While only 22% of the nation’s homeowners live in the top 10 metro markets, they account for 31% of total spending on home improvements, above and beyond routine maintenance. The top 35 metro areas are home to 43% of homeowners, who account for almost 55% of improvement spending, the JCHS points out.

The outlook

In addition to an expected slow recovery in home prices and sales activity, and the need for repairs on rentals, including investment properties acquired at foreclosure auctions, remodeling activity over the next five to ten years likely will be advanced significantly by the sheer size of the housing stock in the U.S. and the increasing age of many of its homes. As mentioned above, client interest likely will shift a bit more toward making homes more energy efficient and slightly away from purely luxury-oriented renovations.

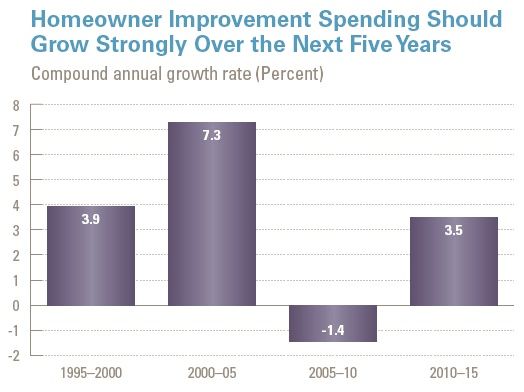

Setting aside broader economic forces, JCHS analysts predicted that average homeowner spending on remodeling would increase annually by about 3.5%, on a compounded basis, through 2015, after adjusting for inflation. About a third of that increase is expected to come from the addition of 4.5 million homeowners to the market, with the remaining 2.3% attributed to increases in per-household spending.

Also in this series:

The Remodeling Industry’s Drift Toward Consolidation

Exploring the Nation’s Metropolitan Areas

Distressed Property Opportunities

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

8067 All-Weather Flashing Tape

Reliable Crimp Connectors

Handy Heat Gun