The Remodeling Industry’s Drift Towrad Consolidation

Part 3 of “A New Decade of Growth for Remodeling,” the five-part analysis produced by the Joint Center for Housing Studies of Harvard University, highlights some of the forces behind the remodeling industry’s gradual drift toward consolidation – a trend that could make the sector more stable during downturns and less prone to churn.

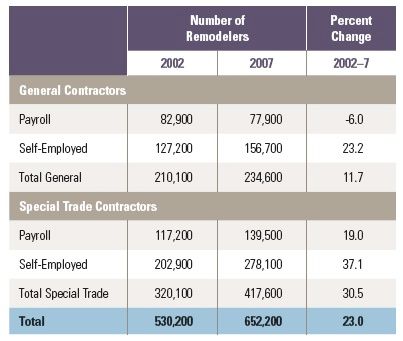

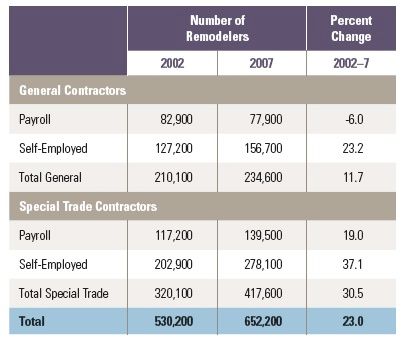

The analysis reiterates several industry axioms about why the residential remodeling business is at once attractive but also, in many cases, extremely challenging for those who get into it. JCHS cites unpublished U.S. Census Bureau figures, for example, showing that more than 650,000 remodeling businesses were in operation in 2007 (the last year for which such data was available), up 22% from 2002, when about 530,000 contractors were focused on remodeling. Most were solo players. During that five-year stretch, the number of self-employed remodelers (most with annual revenues of less than $100,000) rose more than 30%, while remodeling firms with employees saw far smaller increases in payroll.

By 2007, the analysis shows, self-employed contractors comprised more than 66% of all remodeling businesses, up from 62% in 2002. And yet the share of large firms – those that generated $500,000 or more annually – also grew during that period, to almost 30% from 22%, while the share for companies with $1 million-plus annual revenue grew even more, from under 10% to about 15%.

Strength in large-scale operations

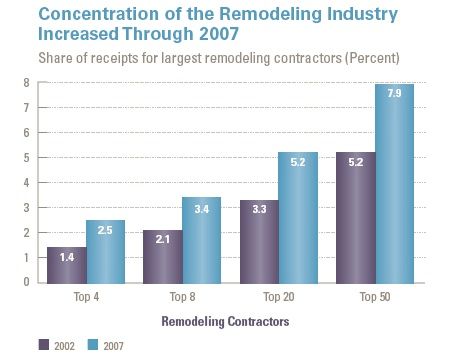

The $1 million-plus companies also took in 66% of receipts in 2007 while providing 55% of employment in the sector and making 65% of the material purchases, according to the JCHS. The analysts also acknowledged that demand for services – particularly higher-end projects at somewhat inflated prices – was near its peak for the decade in 2007, when the top 50 companies took in almost 8% of remodeling revenue.

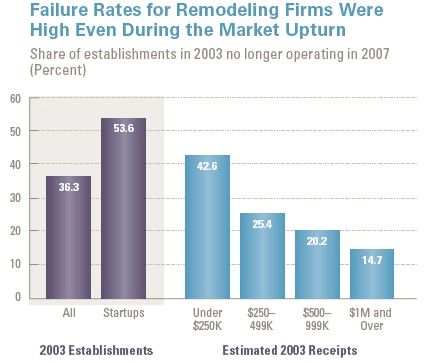

Remodeling’s shift toward consolidation, JCHS notes, mirrors to some extent that in the homebuilding industry. And even though remodelers in most markets tend not to be under quite as much pressure to consolidate as homebuilders, the ranks of remodeling startups have thinned dramatically. Because it is so heavily populated with small, relatively new business that don’t have the financial backup to weather market declines, the home improvement sector saw a large amount of churn even as the market grew, with half of the startups operating in 2003 dropping out of business by 2007.

Specializing and fine-tuning market strategies

The remodelers who have hung on are a hardy bunch. As member surveys in 2009 and 2011 by the National Association of Home Builders indicate, remodelers have been facing increasing competition from builders who entered the home-improvement business after 2007 as a way of coping financially with the downturn. Remodeling was the most popular secondary activity for 45% of the builders surveyed in 2009 (the least popular, attracting only 7% of the vote, was commercial contracting). The 2011 survey showed that remodeling was a primary or secondary business activity for 57% of NAHB members in 2010, up from 53% in 2008.

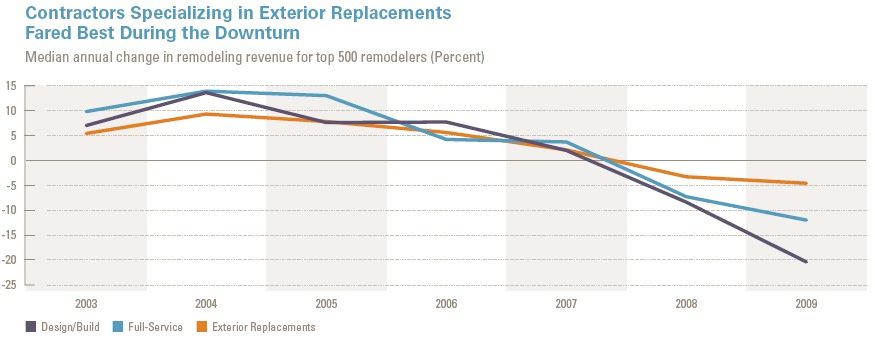

JCHS cites an analysis by Qualified Remodeler magazine that shows revenue growth for remodelers actually began to slow in 2005 and, once the downturn was fully underway, dropped most significantly in 2008 and 2009, when revenues declined almost 4% and then more than 9%, respectively. Surviving the down market has meant, for some, a willingness to take on small-scale projects and, increasingly, focusing on specialty services such as energy efficiency improvements, aging-in-place retrofits, and, for owners of foreclosed homes, property rehabilitation.

More in this Series:

Even with Recent Declines, the Remodeling Market is Nearly $300 Billion

Exploring the Nation’s Metropolitan Areas

Distressed Property Opportunities

The Remodeling Industry’s Drift Towrad Consolidation

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

8067 All-Weather Flashing Tape

Reliable Crimp Connectors

Affordable IR Camera