Remodeling’s Saving Grace

Even though remodeling, like homebuilding, saw remarkable growth from 2000 through 2006, its decline during the economic downturn, while record-breaking, still wasn’t as deep as that of housing.

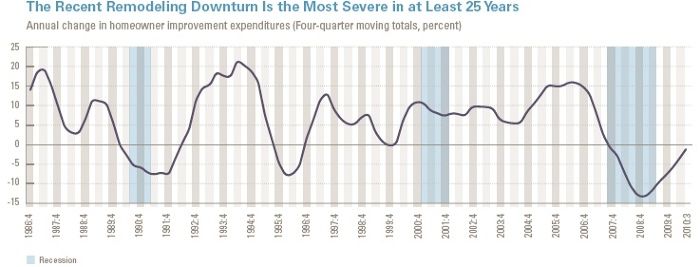

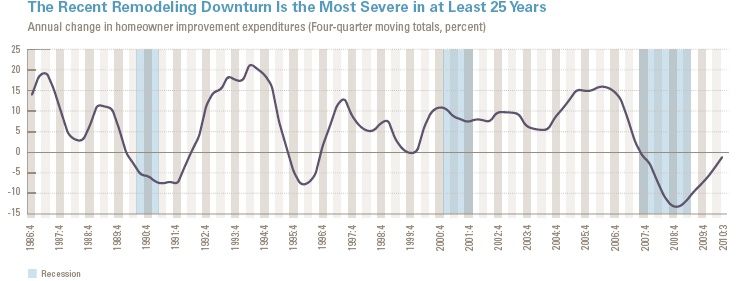

No question: like most industries, remodeling has ridden an economic rollercoaster over the past couple of decades, hitting a high point in home improvement expenditures in 1993 and seeing significant drops in 1990-1991 and 1995. But its buffeting by broader economic turmoil has not included plunges as calamitous as that recently experienced by new-home construction. Part two of “A New Decade of Growth for Remodeling,” a five-part analysis by the Joint Center for Housing Studies of Harvard University, focuses on 2000 through the third quarter of 2010, when remodeling expenditures saw a remarkable (though not record) increase through 2006 and, from 2007 through 2008, their most severe decline in 25 years.

Remodeling and the housing bubble

From 2003 to 2007, the JCHS analysis shows, remodeling expenditures increased by an average of 12% annually, then fell at annual pace of almost 16% from mid-2007 through 2009. Remodeling’s homeowner-spending component alone took a 23% dive during the downturn. Overall, the industry saw a recording-setting decline in client expenditures – although it was nowhere near as severe as the 75% drop in residential construction spending.

Among the key factors in that 23% decline in homeowner spending, the analysis notes, was the drop in the homeownership rate to 67% in 2010 from 69% in 2004 (homeowners tend to spend more on remodeling than owners of rental properties) and, of course, homeowners’ 40% loss of equity, on average, from 2007 to 2010, by which time almost 5% of all mortgaged homes were in foreclosure and almost a quarter were underwater.

Overall, a history of growth

Taking a look at the past several decades, however, Census Bureau data and the JCHS analysis show that the number of homeowners has, on average, increased by about 1% annually, with the share of households electing to spend on remodels tracking within a surprisingly narrow range since 1995: 27% to 30%.

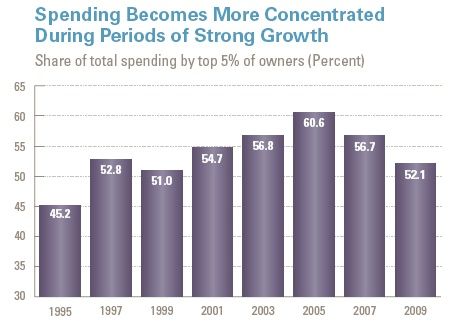

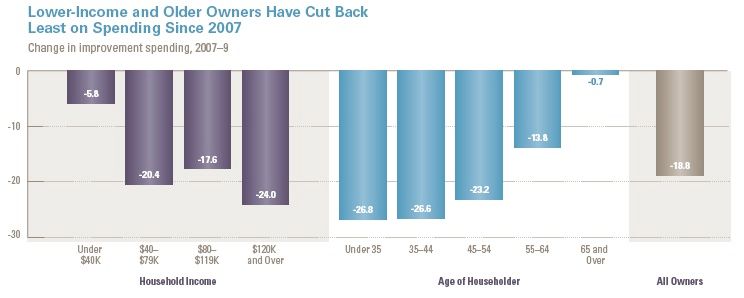

The spending category that took the biggest hit after the bubble burst was for discretionary projects, particularly higher-end projects, which saw a 110% spending increase from 2000 to 2007 and a 23% decline from 2007 through 2009 (versus a 19% decline during that period in overall remodel spending). The top 5% of homeowners – whose properties ultimately saw some of the most substantial drops in equity – accounted for about 60% of expenditures from 2002 through 2007, but only 52% in 2008 and 2009, the JCHS says.

Home-improvement spending by older homeowners tended to hold up better during the downturn because they typically had purchased their homes before the boom and therefore lost less equity during the bust. These homeowners are less likely to follow a do-it-yourself path to remodeling and are more likely to spend on replacement projects (siding, roofing) and system upgrades, including energy efficiency retrofits that might include tax incentives.

More in this Series:

Even with Recent Declines, the Remodeling Market is Nearly $300 Billion

The Remodeling Industry’s Drift Toward Consolidation

Exploring the Nation’s Metropolitan Areas

Distressed Property Opportunities

Fine Homebuilding Recommended Products

Fine Homebuilding receives a commission for items purchased through links on this site, including Amazon Associates and other affiliate advertising programs.

8067 All-Weather Flashing Tape

Handy Heat Gun

Affordable IR Camera

View Comments

I'll have to chime in with a contrary opinion.

Naturally, non of us are prophets - that age is millennia past - so there's no reason to assert that my take is any better than anyone elses'. I just take the same data and put the pieces together differently.

First, 'remodeling' numbers were wildly inflated during the 'housing bubble.' With a whirlwind of sell-paint-sell activity, the numbers did not represent the natural needs, the 'true' market.

As I see it, the 'housing crisis' has hit bottom. It's not that things are better; it's just that anyone who was going to default on their mortgage already has. I expect the supply of 'bargain' properties to dry up.

That's not the same as folks having any money. I expect that remodels will be based on desperate needs, rather than

Sorry for the incomplete post. Seems the computer burped.

I was saying 'no more remodeling on a whim.' No more changing the formica counter for a marble one just because you can.

Housing sales will remain stagnant, with folks moving only when absolutely necessary.

So where to look for business?

Well, there's 'service work,' replacing worn roofs and the like.

Another corner might be the conversion of garages and the construction of 'granny flats.'

Don't leave government out of the equation. With permit applications at near zero, and property taxes declining with the fire-sale prices of foreclosed properties, governments are going to be turning the screws.

While a lot of attention will be given to draconian enforcement, the shortage of cash will join with the increasing regulatory burden to 'stimulate' the unlicensed contractor industry.

We're setting the stage for creating a world where you cannot sell your home without prior approval from code enforcement - who will at that point randomly assess fees for 'improvements' that they think should have had permits long ago.

I took care of the duplicates, Amish Electrician, and then I slightly edited your comment to delete the "duplicate- and" part.

Thanks for the comments.